CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

When Life Throws Curveballs: Why Disability Insurance is Your Safety Net

Discover how disability insurance can protect you when life throws unexpected curveballs. Your safety net awaits!

Understanding Disability Insurance: Your Safety Net During Tough Times

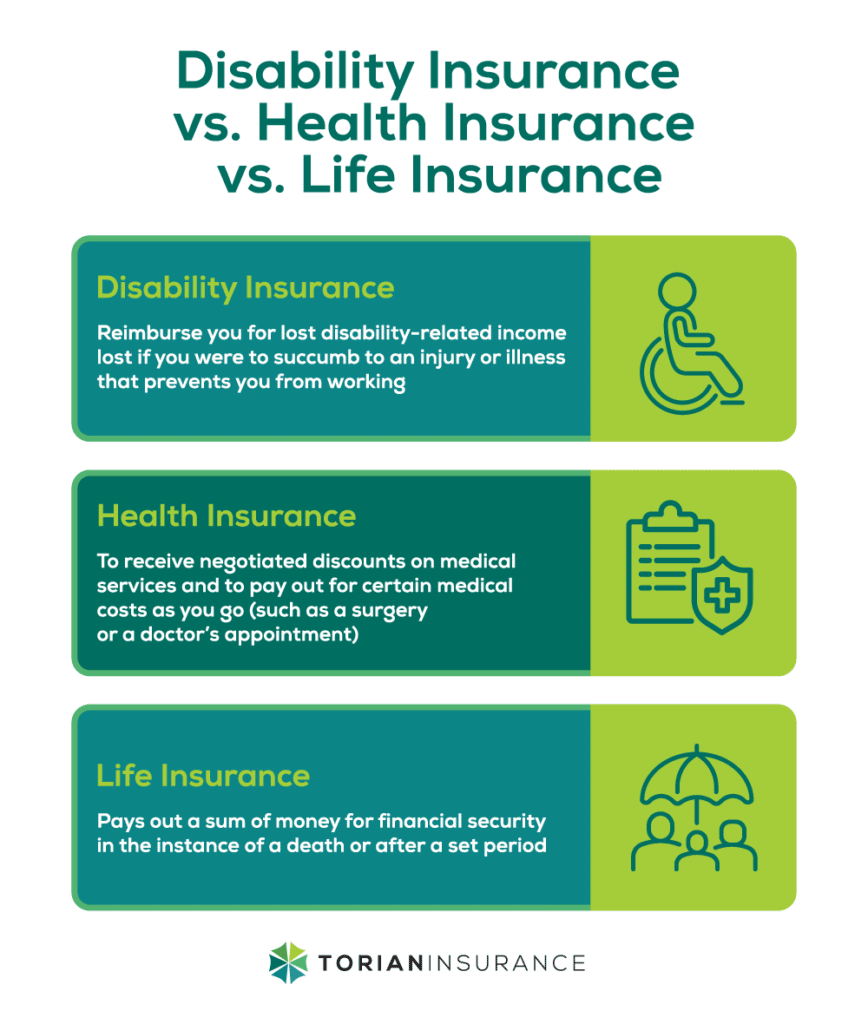

Understanding Disability Insurance is essential for anyone looking to safeguard their financial future against unexpected challenges. This type of insurance acts as a crucial safety net during tough times, providing you with a portion of your income if you become unable to work due to illness or injury. Unlike health insurance, which covers medical expenses, disability insurance specifically addresses the loss of income that can arise when you are unable to perform your job duties. By understanding the various types of policies available, you can make informed decisions that best fit your needs and financial situation.

There are generally two main types of disability insurance: short-term and long-term.

- Short-term disability insurance typically covers a portion of your income for a few months, ideal for temporary disabilities.

- Long-term disability insurance, on the other hand, can provide coverage for several years or even until retirement age, making it critical for serious or prolonged conditions.

Top 5 Reasons Why Disability Insurance is Essential for Everyone

Disability insurance is often overlooked, yet it plays a crucial role in financial planning for everyone. One of the key reasons for its importance is that accidents and illnesses can strike anyone at any time, leading to an inability to work. According to statistics, approximately 1 in 4 workers will experience a disability before reaching retirement age. This highlights the necessity of protecting your income with disability insurance, ensuring that you can meet your living expenses even if you can't work.

Secondly, disability insurance provides peace of mind. Knowing that you have a safety net to fall back on can reduce stress and anxiety about the uncertainties of the future. Life is unpredictable, and having a reliable source of income during tough times not only secures your financial stability but also allows you to focus on recovery and getting back on your feet. In summary, the top 5 reasons why disability insurance is essential for everyone include: financial protection, peace of mind, long-term security, accessibility, and the ability to focus on recovery rather than financial burdens.

Could You Survive a Sudden Disability? The Importance of Having Disability Insurance

Facing a sudden disability can dramatically alter one's life, leading to immense physical, emotional, and financial challenges. Many people underestimate the likelihood of experiencing such an event, often assuming that it won't happen to them. However, studies show that a significant portion of the population will face a disability at some point in their lives. This stark reality highlights the importance of being prepared—specifically, through the acquisition of disability insurance. This coverage can provide crucial financial support, helping to alleviate the burdens associated with lost income and mounting medical expenses.

Having disability insurance is not just about securing your financial future; it’s about ensuring peace of mind. Imagine a scenario where an unexpected injury or illness leaves you unable to work for an extended period—how would you meet your monthly expenses? Disability insurance acts as a safety net, offering replacement income and preventing financial turmoil during challenging times. Additionally, it allows you to focus on recovery rather than worrying about your bills. Ultimately, investing in this type of coverage is a proactive step toward protecting yourself and your loved ones from unforeseen hardships.