CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Blockchain: The Invisible Hand of the Digital Economy

Discover how blockchain is reshaping the digital economy—uncover the invisible forces driving innovation and trust in the online world!

How Blockchain Technology is Reshaping the Digital Economy

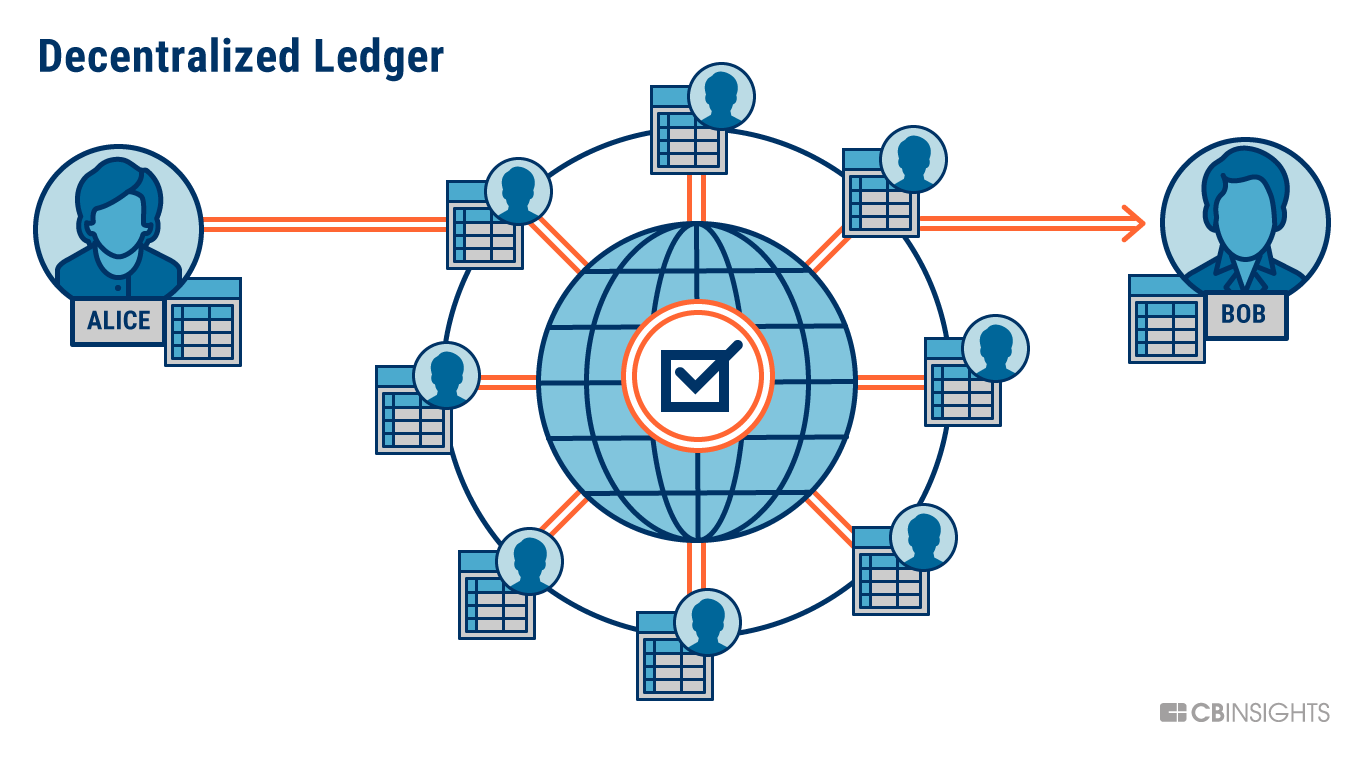

Blockchain technology is revolutionizing the digital economy by enabling unprecedented levels of transparency and security in transactions. Unlike traditional systems that rely on central authorities, blockchain operates on a decentralized network, allowing users to directly exchange value without intermediaries. This shift not only reduces costs but also mitigates the risks of fraud and data tampering, making it an attractive option for a wide range of industries. As businesses increasingly adopt this technology, we are witnessing a transformation in how digital assets are created, transferred, and managed.

The impact of blockchain extends beyond mere financial transactions; it is also reshaping the very fabric of digital trust. Smart contracts, which automate the execution of agreements when certain conditions are met, are streamlining operations across various sectors such as real estate, supply chain management, and healthcare. Furthermore, blockchain technology facilitates the rise of new economic models, such as decentralized finance (DeFi) and tokenized assets, providing individuals and businesses with more control over their financial futures. As blockchain continues to mature, its role in shaping the digital economy is set to expand, unlocking new opportunities for innovation and growth.

Exploring the Role of Decentralization in Modern Financial Systems

Decentralization has emerged as a critical concept in modern financial systems, fundamentally altering the way financial transactions and services operate. Unlike traditional systems that rely on centralized authorities, such as banks and governments, decentralized finance (DeFi) leverages blockchain technology to create an open and transparent ecosystem. This shift enables users to engage in peer-to-peer transactions without intermediaries, reducing costs and increasing accessibility. As decentralization continues to evolve, it empowers individuals to take control of their financial assets, fostering innovation and competition in the market.

Moreover, decentralization enhances security and trust among participants in financial systems. By distributing data across a network of nodes, blockchain technology minimizes the risk of single points of failure and cyberattacks. This decentralized architecture ensures that transaction records are immutable and transparent, enhancing accountability and reducing fraud. As financial institutions begin to recognize the importance of decentralization, we can expect a shift towards more resilient and equitable financial systems that democratize access to financial services worldwide.

Is Blockchain the Future of Trust in Digital Transactions?

The rise of blockchain technology has sparked a revolutionary change in how we conceptualize trust within digital transactions. Traditional models rely heavily on intermediaries, like banks and payment processors, to validate and secure transactions. However, with blockchain's decentralized architecture, transactions can be executed directly between parties, significantly reducing the risk of fraud and enhancing security. This shift not only minimizes costs associated with middlemen but also promotes transparency, as each transaction is recorded on a public ledger that can be audited by anyone, thereby fostering a greater sense of trust.

Furthermore, the immutable nature of blockchain adds an additional layer of trust. Once a transaction is recorded, it cannot be altered or deleted, which ensures that the data remains intact and verifiable. As businesses and consumers increasingly seek reliable methods to conduct transactions online, the demand for trustworthy solutions like blockchain will likely grow. According to many experts, the potential of blockchain extends beyond cryptocurrency; it could redefine industries such as supply chain management, healthcare, and even voting systems by providing a secure, transparent, and efficient means of verifying transactions.