CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

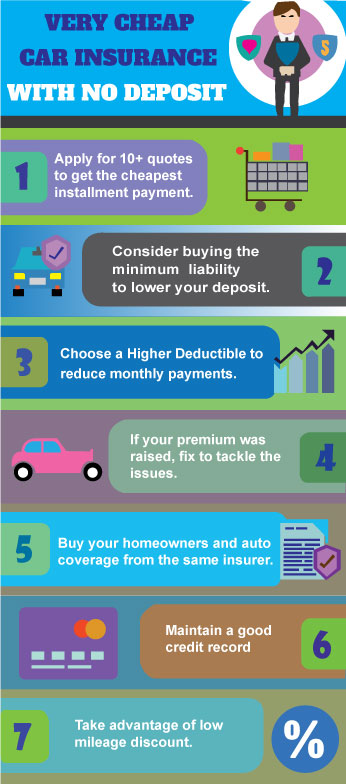

Cheap Insurance: Saving Money Without the Heartache

Discover how to find affordable insurance and save money without the stress—your wallet will thank you!

Top 5 Tips for Finding Affordable Insurance Without Compromising Coverage

Finding affordable insurance can feel like a daunting task, but it doesn't have to be. One of the best strategies is to shop around and compare quotes from multiple providers. Always request quotes based on similar coverage levels to ensure you're making an apples-to-apples comparison. Additionally, consider using online comparison tools to streamline the process. Keep in mind that affordable insurance doesn't mean you have to settle for less; many providers offer discounts for bundling policies or maintaining a good driving record.

Another effective tip is to review your coverage needs regularly. Insurance policies can become outdated as your circumstances change, such as moving to a new house, adding a family member, or changing your vehicle. By understanding what coverage you truly need, you can avoid paying for unnecessary features. Furthermore, don't hesitate to ask your insurer about potential discounts they may offer, such as for completing safety courses or having a home security system. Following these steps can help you find the right balance between affordability and comprehensive coverage.

How to Compare Insurance Quotes: Save Money and Avoid the Heartache

When it comes to comparing insurance quotes, the first step to save money and avoid the heartache is to gather information from multiple insurance providers. Start by preparing a list of coverage options that suit your needs. You can either visit individual company websites or use comparison tools. Make sure to consider the same coverage limits, deductibles, and additional features to ensure you are making an apples-to-apples comparison. This will help you spot the best deals and understand which policies provide the most value for your money.

Once you have collected all your quotes, take the time to analyze the details. Create a spreadsheet or use a table to lay out the quotes side by side. Look carefully at the premiums, deductibles, and the coverage specifics. Don't forget to read the fine print, as hidden fees and exclusions can significantly impact your final decision. In addition, consider customer service and claim handling records of each insurance provider, as these factors heavily influence long-term satisfaction. By thoroughly comparing these aspects, you can make an informed choice that saves you money and keeps you from future frustrations.

Common Myths About Cheap Insurance: What You Need to Know

When it comes to insurance, many people believe that cheap insurance means low quality. This is one of the most common myths surrounding affordable insurance options. In reality, the price of an insurance policy doesn't always correlate with the level of coverage. Many reputable companies offer cheap insurance plans that can provide adequate protection for your needs without breaking the bank. It's essential to research different providers and understand the coverage options they offer rather than dismissing inexpensive plans outright.

Another myth is that cheap insurance is often not enough. While it's true that some low-cost policies may have limited coverage, there are many affordable insurance options available that offer comprehensive coverage. To debunk this myth, consider comparing multiple insurance policies and looking for hidden fees or exclusions. Reading customer reviews and consulting with insurance experts can also help you find a reliable policy that won't compromise your financial security.