CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Discounts in Disguise: Hidden Gems in Auto Insurance

Uncover secret savings in auto insurance! Discover hidden gems and unlock discounts in disguise that could save you big.

Unlocking Savings: Top 5 Hidden Discounts in Auto Insurance

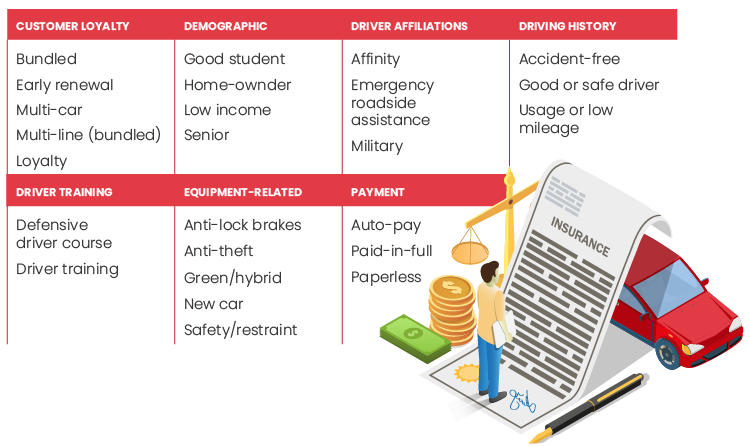

Finding hidden discounts in auto insurance can significantly reduce your premiums and maximize your savings. Many drivers are unaware that their insurance providers offer a variety of discounts that can be easily overlooked. Here are the top five hidden discounts that you might be eligible for:

- Bundling Discounts: If you have multiple policies, such as home and auto insurance, bundling them can lead to substantial savings.

- Good Driver Discounts: Maintaining a clean driving record without accidents or claims can qualify you for lower rates.

- Low Mileage Discounts: If you drive less than a certain number of miles per year, some insurers may offer discounts for being a low-mileage driver.

- Payment Discounts: Paying your premium in full or setting up automatic payments can oftentimes earn you additional savings.

- Membership Discounts: Certain organizations or employers may have partnerships with insurance providers that offer exclusive discounts.

The Ultimate Guide to Uncovering Overlooked Auto Insurance Benefits

Navigating the world of auto insurance can be overwhelming, especially with the myriad of options available. Many policyholders are aware of standard coverage options like liability and collision, but often neglect to explore overlooked auto insurance benefits. These hidden gems can provide significant savings and protection for drivers. For instance, many insurers offer roadside assistance as part of their policy, which can be invaluable during unforeseen circumstances such as a flat tire or engine failure. Additionally, rental car reimbursement can help alleviate the financial burden of transportation while your vehicle is being repaired. These benefits not only enhance your coverage but also offer peace of mind during your daily commutes.

Another critical aspect of overlooked auto insurance benefits is the accidental death and dismemberment coverage, which can provide financial support to your beneficiaries in the unfortunate event of an accident. Moreover, many insurance companies have partnership programs that extend discounts for safe driving or for bundling policies, which can lower your overall insurance costs. Always remember to read your policy carefully and regularly check in with your agent to uncover any changes or updates to your coverage. By taking advantage of these often-missed benefits, you can not only enhance your protection but also potentially save money in the long run.

Are You Missing Out? Common Misconceptions About Auto Insurance Discounts

When it comes to auto insurance, many drivers unknowingly miss out on valuable savings due to common misconceptions. One prevalent myth is that all insurance providers offer the same discounts. In reality, discounts can vary significantly between companies, and it's essential to shop around to find the best deals. You might be surprised to learn that factors like your occupation, driving history, and even your vehicle's safety features can qualify you for reductions in premium costs. By not exploring these possibilities, you could be leaving money on the table.

Another widespread misunderstanding is that discounts are primarily for young drivers or those with clean driving records. While it's true that these groups may benefit from specific offers, auto insurance discounts are often available to a wider range of drivers than many realize. For example, some companies provide discounts for completing defensive driving courses, bundling policies, or being a loyal customer. Always inquire about available discounts during your policy review; you may be pleasantly surprised at the savings you could achieve.