CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Discounts Unleashed: Save Big on Your Auto Insurance

Unlock massive savings on auto insurance! Discover exclusive discounts and tips to slash your rates and keep your wallet happy.

Unlocking Hidden Discounts: How to Save on Your Auto Insurance Premiums

Auto insurance premiums can often feel like a burden on your monthly budget, but many drivers are unaware of the hidden discounts available to them. To save on your auto insurance premiums, it’s essential to start by reaching out to your insurance provider and asking about any discounts that may apply to your situation. Common options include multi-policy discounts for bundling home and auto insurance, good driver discounts for maintaining a clean driving record, and discounts for completing defensive driving courses. Keeping an eye out for these opportunities can significantly reduce your premium costs.

In addition to the traditional discounts offered, consider implementing some proactive steps to further decrease your auto insurance premiums. For instance, increasing your deductible can lower your premium substantially, provided you’re comfortable absorbing a higher cost in the event of a claim. Additionally, many insurers provide discounts for vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft systems. By exploring these avenues and regularly reviewing your policy, you can effectively unlock hidden discounts and keep your auto insurance costs manageable.

Top 10 Tips to Maximize Your Auto Insurance Discounts

When it comes to maximizing your auto insurance discounts, understanding the various types of discounts available is essential. Most insurance companies offer a variety of savings options that can significantly lower your premium. Here are the top 10 tips to help you take full advantage of these discounts:

- Bundle Your Policies: Many insurers provide discounts if you purchase multiple types of insurance, such as home and auto, from them.

- Maintain a Good Driving Record: A clean driving history free of accidents and violations can qualify you for safe driver discounts.

- Take a Defensive Driving Course: Completing an accredited defensive driving course not only improves your skills but may also earn you additional savings.

Moreover, it is crucial to keep your vehicle information up to date. Insurance companies often offer discounts based on vehicle safety ratings and features. Newer vehicles with advanced safety technology can qualify for lower rates. To further maximize your auto insurance discounts, consider the following tips:

- Review Your Coverage Regularly: As your circumstances change, ensure you’re not paying for coverage you don’t need.

- Ask About Discounts: Don’t hesitate to ask your insurance agent about any available discounts that you may qualify for.

- Pay Your Premium Annually: Paying your premium upfront instead of monthly can often lead to significant savings.

Are You Missing Out? Common Auto Insurance Discounts You Might Qualify For

Auto insurance can often feel like a significant expense, but many drivers are unaware of the common auto insurance discounts that could substantially lower their premiums. These discounts can range from multi-policy discounts to safe driver discounts. For example, bundling your homeowners or renters insurance with your auto policy can lead to substantial savings. Similarly, maintaining a clean driving record free of accidents and tickets usually qualifies you for a safe driver discount. Don't hesitate to ask your insurer about the specific discounts they offer, as eligibility can vary widely.

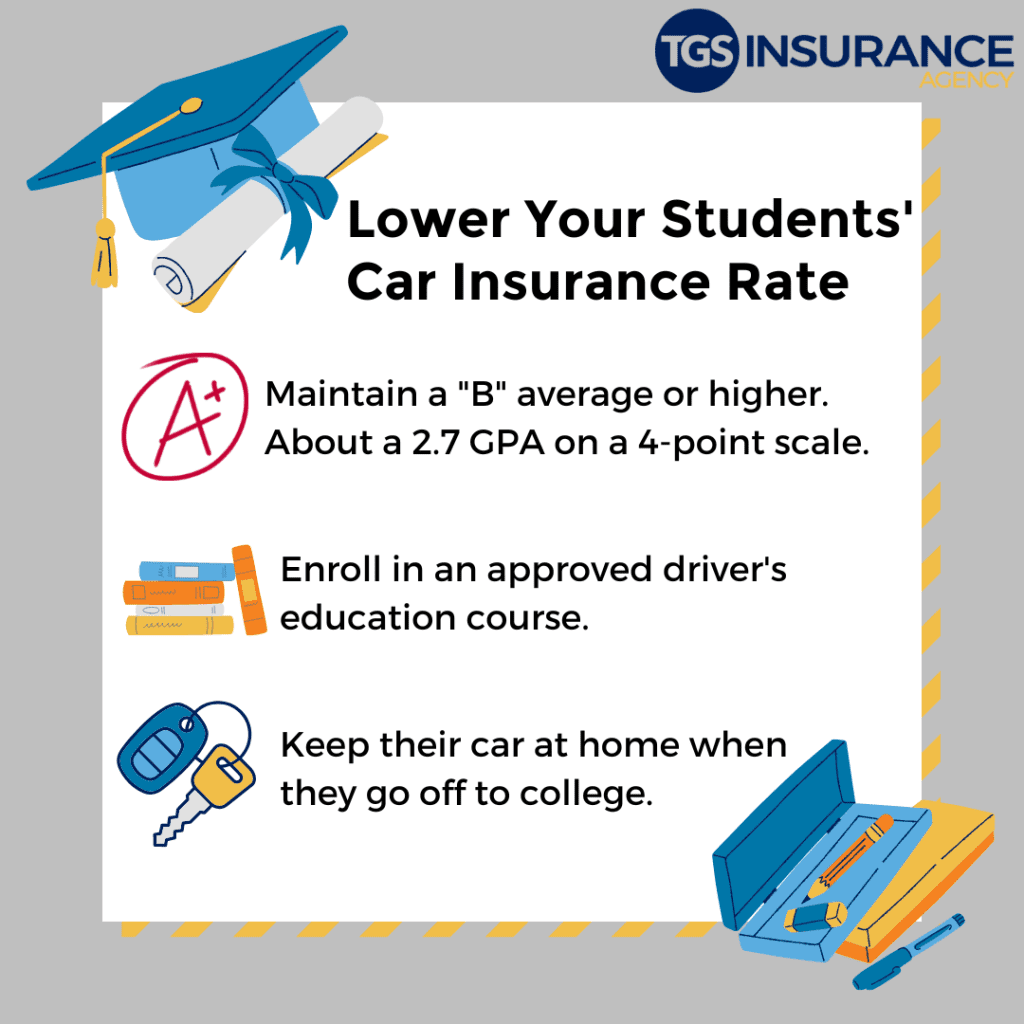

Also worth exploring are discounts related to your vehicle and lifestyle. For example, if your car is equipped with safety features such as anti-lock brakes or airbags, you might be eligible for a vehicle safety discount. Additionally, students can often take advantage of good student discounts, while members of certain organizations may be able to benefit from affinity discounts. To ensure you're not missing out, take the time to review your policy and discuss any potential discounts with your insurance agent.