CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance That's Easy on Your Wallet: Finding Bargains Without the Hassle

Discover budget-friendly insurance tips that save you money without the hassle. Easy savings are just one click away!

Top 5 Tips for Finding Affordable Insurance Plans

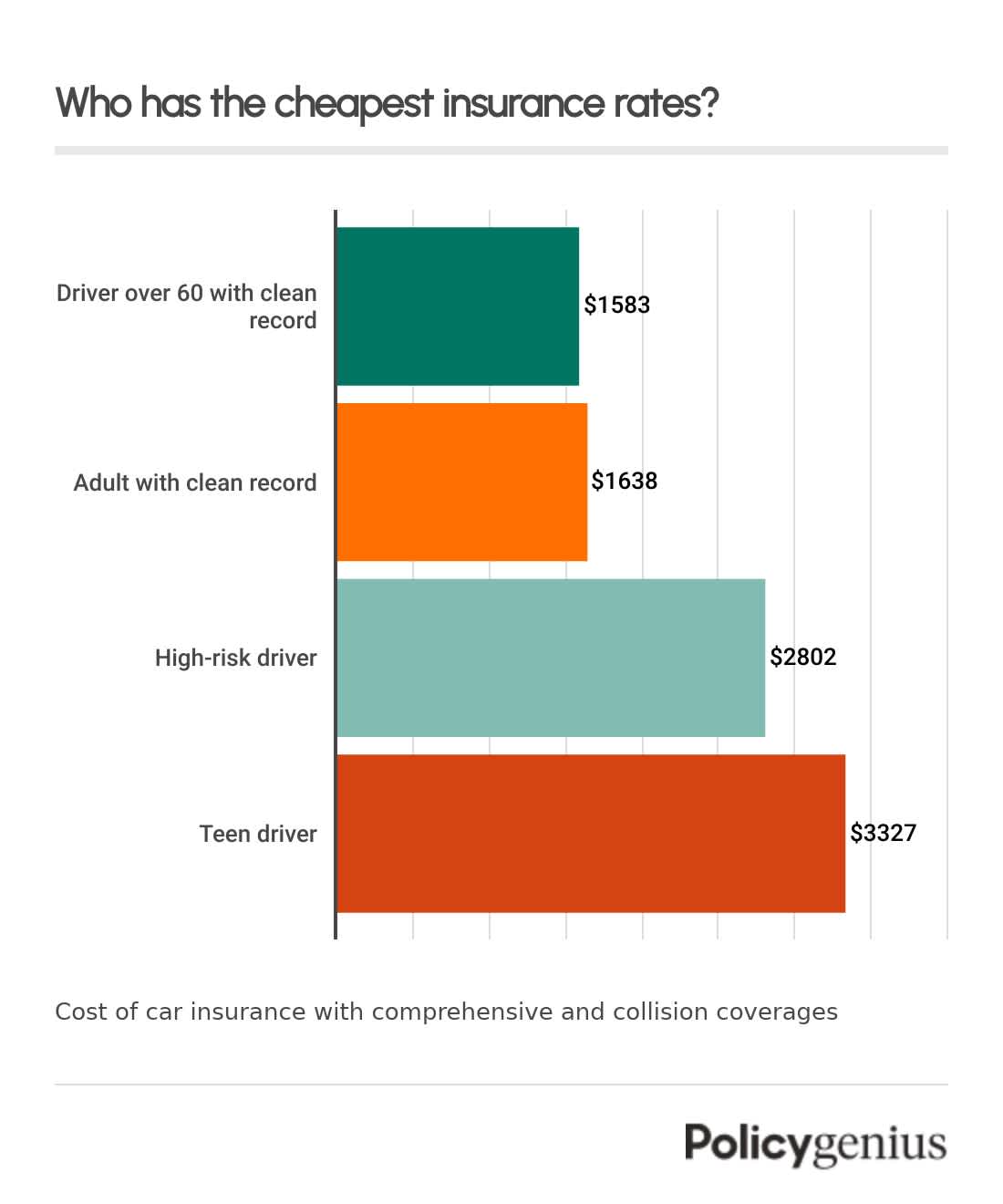

Finding affordable insurance plans can feel overwhelming, but with the right approach, you can secure coverage that fits your budget. Start by shopping around and comparing quotes from multiple insurance providers. Websites that aggregate quotes can save you time and provide a better sense of the market. Additionally, be sure to inquire about discounts that may apply to you, such as bundling insurance policies or maintaining a good driving record, which can significantly reduce your premiums.

Another important tip is to assess your coverage needs accurately. Determine the essential coverage levels required for your situation—whether it's health, auto, or home insurance. Sometimes, opting for a higher deductible can lower your monthly payments, but ensure you can afford the out-of-pocket costs in case of a claim. Lastly, never hesitate to negotiate; many insurance agents are willing to adjust terms to find a satisfactory plan for both parties.

How to Compare Insurance Quotes Without the Stress

Comparing insurance quotes can often feel overwhelming, but it doesn’t have to be. Start by gathering all the necessary information about your current insurance policies and any specific coverage requirements. Make a list of your priorities, such as cost, coverage levels, deductibles, and customer service ratings. This will help you stay organized and focused as you evaluate each option. Use online tools or insurance comparison websites to easily compare multiple quotes side by side, ensuring that you don’t miss any important details that could affect your decision.

Once you have a list of quotes, take the time to read the fine print. It’s crucial to understand what each policy covers and excludes, as well as any additional fees that may apply. Don't hesitate to reach out to insurance agents for clarifications on complex terms. Additionally, consider checking reviews from current policyholders to gauge their satisfaction with the provider. By approaching the comparison process methodically and being informed, you can compare insurance quotes without the stress, ultimately choosing the right coverage that fits your needs and budget.

Common Mistakes to Avoid When Shopping for Budget-Friendly Insurance

When shopping for budget-friendly insurance, one of the most common mistakes consumers make is not comparing multiple quotes. Relying solely on one provider can lead to missing out on better rates and coverage options available in the market. To ensure you are making an informed decision, consider using an insurance comparison tool or visiting multiple insurance company websites to gather quotes. Also, don't forget to check for any hidden fees or terms that may affect your overall cost.

Another pitfall is underestimating the importance of coverage details when selecting budget-friendly insurance. While it may be tempting to go for the cheapest option, it is crucial to understand what is and isn't covered in the policy. Read through the fine print and ask your insurer about any exclusions. Additionally, consider your personal needs and circumstances: a slightly higher premium might save you money in the long run if it offers better coverage for your specific requirements.