CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

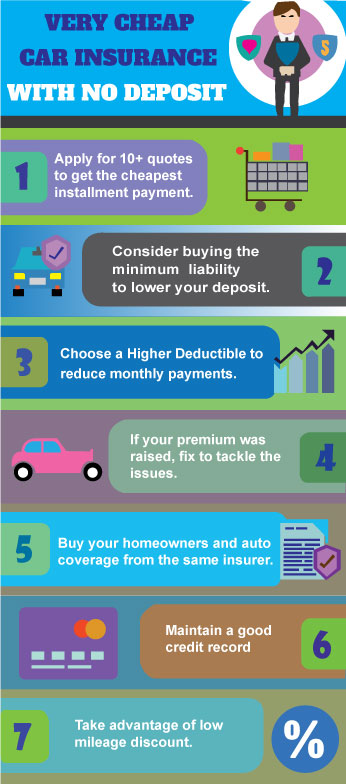

Insurance on a Budget: How to Save Without the Sacrifice

Discover clever tips to save on insurance without compromising coverage. Unlock your budget-friendly insurance strategy today!

Top 5 Tips to Slash Your Insurance Costs Without Compromising Coverage

In today's economy, finding ways to slash your insurance costs without compromising on coverage is essential. Here are the top 5 tips to help you save money while still protecting yourself adequately:

- Shop Around: Never settle for the first quote you receive. Different insurers offer varying rates and coverage options, so take the time to compare.

- Bundle Your Policies: Many insurance companies offer discounts if you bundle multiple policies together, such as home and auto insurance.

- Increase Your Deductible: Opting for a higher deductible can lower your premium. Just ensure you have enough savings to cover the deductible if needed.

- Maintain a Good Credit Score: Insurers often consider your credit score when determining rates, so keeping it high can lead to better premiums.

- Review Your Coverage Regularly: Life changes tied to your lifestyle can affect your coverage needs. Regularly assess your policies to ensure they still align with your current situation.

Understanding the Fine Print: How to Find Affordable Insurance Policies

Finding affordable insurance policies can often feel overwhelming, but understanding the fine print is crucial. Start by comparing different types of insurance, such as health, auto, and home insurance. Consider using comparison websites that allow you to see multiple options at once. Pay attention to policy limits, deductibles, and coverage exclusions, as these factors can significantly impact the overall cost and effectiveness of your insurance. As you navigate the options, keep a checklist of your needs, ensuring that the policy you choose offers the appropriate coverage without unnecessary extras.

It’s also beneficial to ask providers about any discounts that may apply to your situation, such as bundling multiple policies or safe driving discounts for auto insurance. Additionally, read customer reviews and seek recommendations to gauge the provider's reliability and service quality. Remember, a policy with the lowest premium may not always be the best choice if it lacks critical coverage or has high out-of-pocket costs. By carefully reviewing the fine print and weighing your options, you can secure an insurance policy that fits your budget while providing the necessary protection.

Is Cheap Insurance Worth It? A Deep Dive into Value vs. Cost

When considering cheap insurance, it’s essential to weigh the value against the cost. While low premiums can be enticing, they often come with higher deductibles and reduced coverage options. This means that in the event of a claim, policyholders may find themselves paying significantly out-of-pocket. A critical aspect to evaluate is whether the savings on premiums genuinely offset the potential financial risks associated with inadequate coverage. For instance, if a policy covers only a fraction of potential damages, the initial savings may quickly evaporate when faced with unexpected expenses.

Moreover, cheap insurance may not offer the same level of customer service or support during the claims process. Many budget insurers streamline their operations to minimize costs, which can lead to longer wait times and less personalized assistance when you need it most. Therefore, it’s vital to read reviews and assess the reputability of a provider before opting for the lowest price. Ultimately, finding a **balance** between affordability and comprehensive coverage is key—sometimes it's worth investing a bit more for peace of mind and robust protection.