CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance Quotes: How to Snag a Deal Without Losing Your Mind

Discover insider tips to score unbeatable insurance quotes without the stress. Save money and sanity—your wallet will thank you!

10 Tips for Finding the Best Insurance Quotes Without the Stress

Finding the best insurance quotes can often feel overwhelming, but it doesn’t have to be. Start by gathering necessary information about your coverage needs, including details about your vehicle or property, as well as your personal information. Once you have everything you need, consider utilizing online comparison tools that can streamline your search, allowing you to view multiple quotes in one place. By taking this approach, you can save time and reduce stress in finding the right insurance policy.

Additionally, don’t hesitate to reach out to multiple insurers for personalized quotes. Speaking with an agent can provide insights into various discounts you may qualify for, which could significantly lower your premium. Also, remember to check customer reviews and ratings for each insurance provider to ensure you're choosing a company that not only offers competitive pricing but also exceptional customer service. By following these tips, you’ll be well on your way to finding the best insurance quotes without the hassle.

Understanding Insurance Quotes: What You Need to Know to Save Money

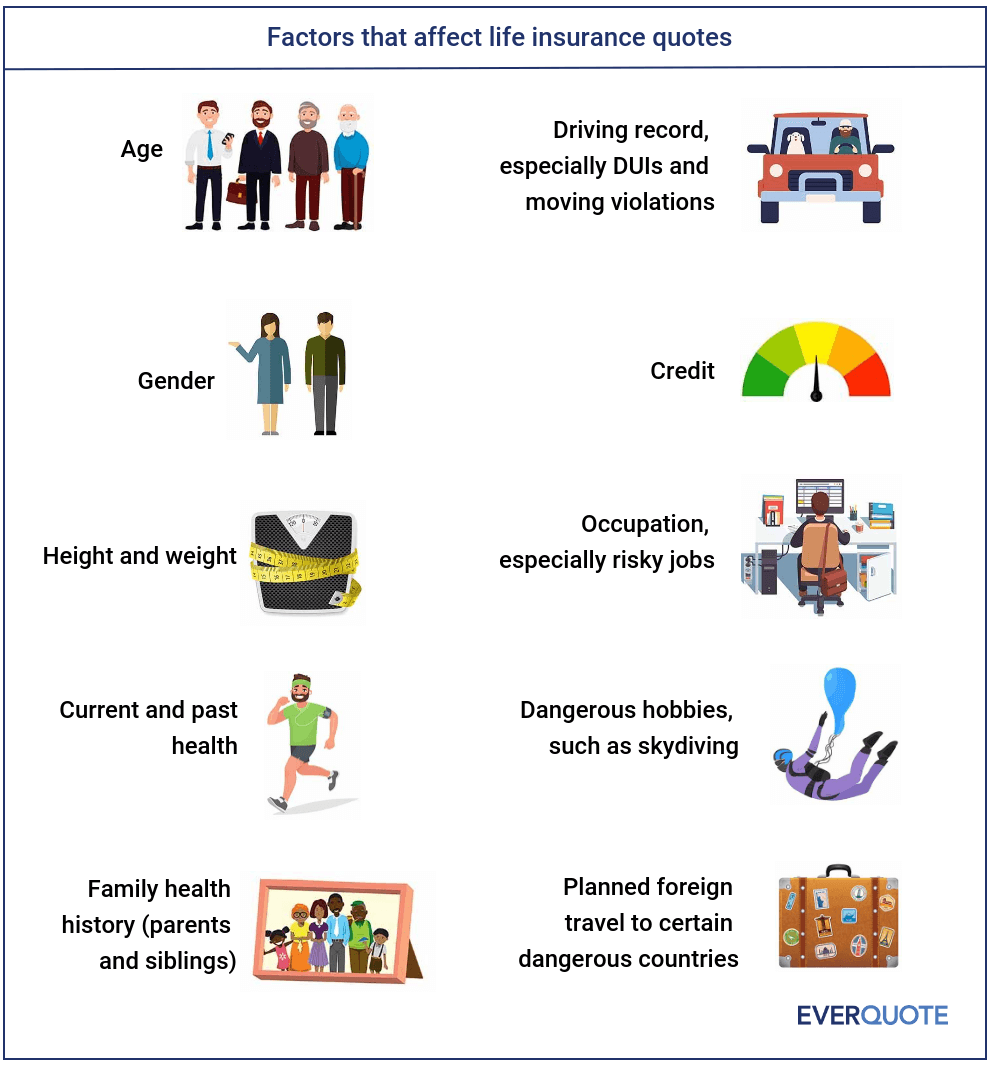

Understanding insurance quotes is crucial for anyone looking to save money on their premiums. When you start shopping for insurance, whether it's for auto, home, or health, you'll come across various quotes that represent the cost of coverage. It’s important to gather quotes from multiple providers to compare them effectively. Insurance quotes can vary significantly based on numerous factors, including your age, location, driving record, and the type of coverage you need. By evaluating these quotes carefully, you can identify the best possible deal that fits your financial needs.

To maximize your savings, consider these key tips when reviewing insurance quotes:

- Request personalized quotes by providing accurate information about your circumstances.

- Look for available discounts, such as good driver discounts or bundling policies.

- Review the coverage details, ensuring that you’re comparing similar plans.

- Ask for clarification on any terms you don’t understand to avoid hidden fees.

Common Questions About Insurance Quotes: Get Answers to Make Informed Decisions

When seeking insurance quotes, many individuals have common questions that arise during the process. One of the primary concerns is what factors influence the cost of an insurance quote. Insurance companies consider various elements such as the applicant's age, the type of coverage desired, and their claims history. Additionally, geographical location can play a significant role, as different areas may have varying risk levels associated with insurable events like natural disasters or theft.

Another frequent question is, 'How can I ensure I get the best rate while reviewing my insurance quotes?' To make informed decisions, it's essential to compare multiple quotes from different providers. Consider asking for detailed breakdowns of each quote to understand what is included in the coverage. Tips such as bundling insurance policies, maintaining a good credit score, and asking about discounts can also help you secure a better rate. Remember, taking the time to research and ask questions can lead to significant savings and tailored coverage that suits your needs.