CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance Showdown: Finding Your Perfect Match

Discover the ultimate insurance showdown and find your perfect match! Unlock tips, insights, and expert advice to secure your best policy today!

Understanding Different Types of Insurance: Which One is Right for You?

Choosing the right type of insurance can seem overwhelming with the plethora of options available. Insurance is essential for protecting your assets and providing peace of mind, but different types cater to varying needs. Here are a few main types of insurance to consider:

- Health Insurance: Covers medical expenses, ensuring access to healthcare when needed.

- Auto Insurance: Protects against financial loss in case of vehicle accidents or theft.

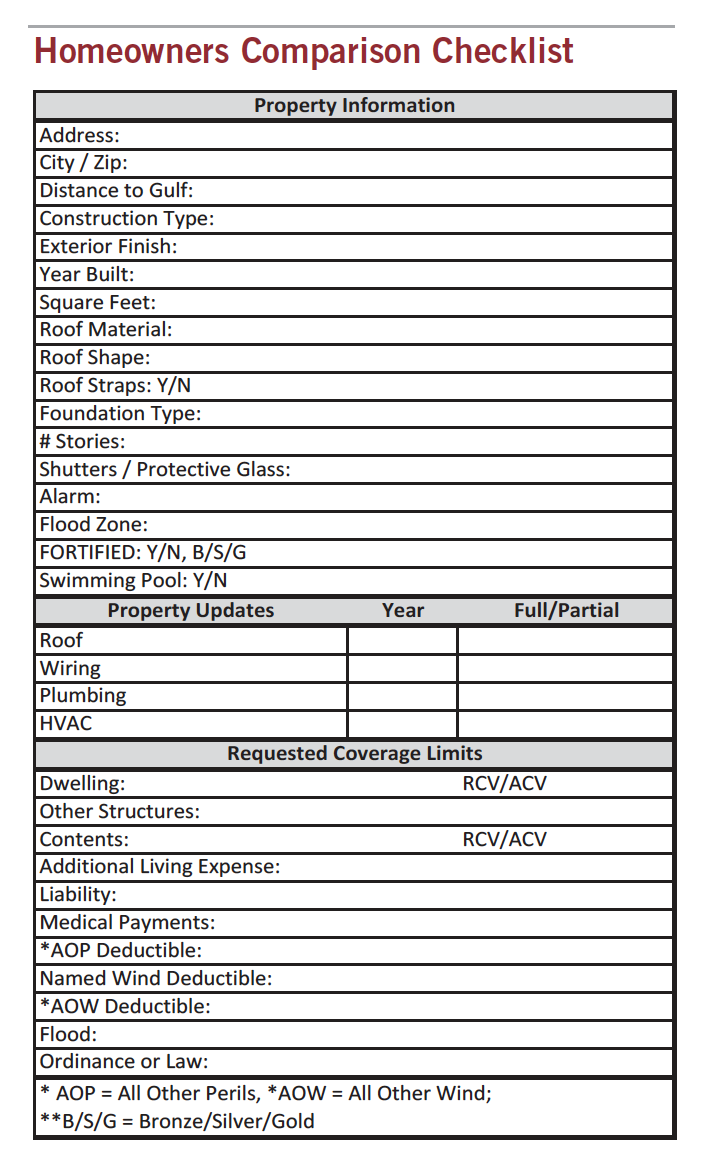

- Homeowners Insurance: Safeguards your home and belongings from damages or theft.

- Life Insurance: Provides financial support to your beneficiaries in the event of your death.

To determine which type of insurance is right for you, it's important to assess your personal circumstances and priorities. Begin by evaluating factors such as your lifestyle, dependents, and existing assets. For instance, if you own a home, homeowners insurance is crucial; conversely, if you rent, renter’s insurance may be more appropriate. Additionally, consider discussing your options with a financial advisor or insurance agent who can guide you through the decision-making process and help you find coverage that fits your budget and needs.

The Ultimate Guide to Comparing Insurance Policies: Key Factors to Consider

Comparing insurance policies can be a daunting task, but understanding the key factors that influence your decisions can simplify the process. When evaluating policies, start by considering the type of coverage you need. Different policies are tailored to specific situations, whether it's health, auto, home, or life insurance. Once you have identified the type of insurance, focus on these essential aspects:

- Premiums: The cost you pay for coverage.

- Deductibles: The amount you must pay out-of-pocket before coverage kicks in.

- Coverage Limits: The maximum amount the insurer will pay in a claim.

- Exclusions: Situations or items not covered by the policy.

Another critical factor in comparing insurance policies is the insurer's reputation and customer service. Look for customer reviews and ratings from trusted sources, as these can provide insights into the insurer's reliability and responsiveness when claims arise. Furthermore, consider the financial stability of the company, which can be assessed through ratings provided by organizations like A.M. Best or Standard & Poor's. By examining both the coverage details and the insurer's credibility, you can make a well-informed decision that ensures you select the policy that best meets your needs.

Do You Really Need Insurance? Common Myths Debunked

Insurance often raises questions and doubts, leading many to believe common myths that can deter them from making informed decisions. One prevalent myth is that insurance is an unnecessary expense, especially for the young and healthy. However, this perspective overlooks the unpredictability of life. Accidents and unforeseen events can occur at any time, and without adequate coverage, these incidents could lead to substantial financial burdens. It's crucial to recognize that insurance provides a safety net, ensuring that individuals and families can recover from unexpected hardships without crippling financial strain.

Another common misconception is that insurance will cover everything. In reality, insurance policies come with specific terms, conditions, and exclusions. Understanding the nuances of your policy is essential to ensure you are adequately protected. For instance, many believe that their health insurance will cover all medical bills, but this is often not the case due to deductibles and co-pays. Therefore, being well-informed about what your insurance entails can help you avoid unpleasant surprises when you need to file a claim.