CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

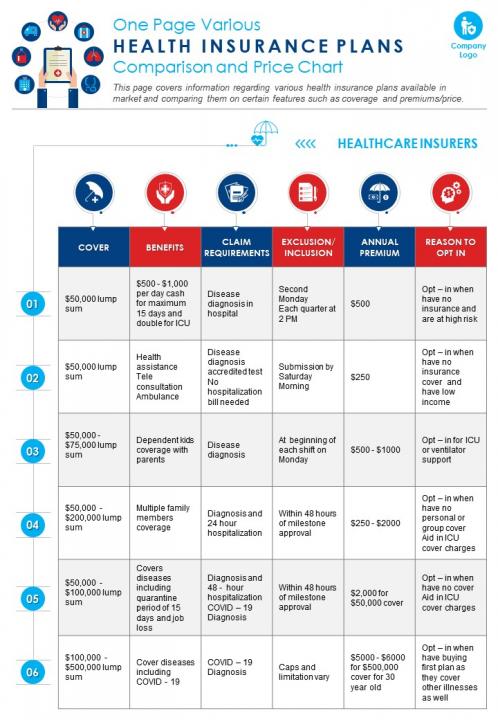

Insurance Smackdown: Finding Your Best Coverage Match

Discover the ultimate showdown in insurance! Uncover tips to find your best coverage match and save money today!

Understanding Different Types of Insurance: Which One is Right for You?

Understanding the diverse landscape of insurance is crucial for making informed decisions about your financial security. There are several types of insurance available, each serving a unique purpose. The most common categories include health insurance, auto insurance, homeowner's insurance, and life insurance. Health insurance covers medical expenses, while auto insurance protects against vehicle-related liabilities and damages. Homeowner's insurance offers financial protection for your property and belongings, whereas life insurance provides financial support to beneficiaries in the event of the policyholder's death. Understanding these options can help you assess which type fits your personal and financial needs.

When evaluating what might be the right type of insurance for you, consider the following factors:

- Your lifestyle: Your daily habits and activities can influence the types of insurance you need. For instance, if you drive frequently, auto insurance is essential.

- Your family situation: If you have dependents, life insurance may be important to secure their financial future.

- Asset protection: Evaluate what you own and the potential risks. Homeowner's insurance will be vital for homeowners, while renters might consider renters insurance to cover their personal belongings.

The Ultimate Guide to Comparing Insurance Quotes: Tips and Tricks

When it comes to comparing insurance quotes, having a methodical approach is essential to ensure you find the best coverage at the best price. Start by gathering multiple quotes from various providers; this can typically be done online in a matter of minutes. As you collect these quotes, pay close attention to the coverage details and additional fees, which can drastically affect the overall cost of your policy. Here are some tips to keep in mind:

- Identify the specific coverage needs you have.

- Make sure you are comparing similar policies.

- Look for discounts that may apply to you.

Once you have your quotes lined up, it’s time to evaluate them. Not all quotes are created equal, and comparing them superficially could lead to poor decisions. Take the time to read through the fine print, and don't hesitate to reach out to agents for clarifications. Remember, the cheapest option isn't always the best; consider customer service ratings and the insurer's reputation as well. A well-rounded evaluation could save you money in the long run while ensuring you are adequately covered. Use the following checklist to help with your comparison:

- Review customer reviews and ratings.

- Assess financial stability and claims process.

- Compare similar limits and deductibles.

Do You Really Need That Coverage? Debunking Common Insurance Myths

When it comes to insurance, many people operate under misconceptions that can lead to inadequate coverage or unnecessary expenses. One common myth is the belief that insurance is a waste of money if you don't file frequent claims. In reality, insurance serves as a safety net, protecting you from unexpected financial burdens. For instance, consider the cost of a major accident or a home disaster; these could have devastating effects on your finances if you're not adequately insured. It's crucial to evaluate your risks and ensure that your coverage aligns with your individual needs.

Another prevalent myth is that all policies are the same, making it unimportant to shop around. This misconception can result in missed opportunities for better coverage at lower prices. Different insurers offer varying terms, conditions, and premiums that can significantly impact your overall financial well-being. To make an informed decision, it’s essential to research and compare different policies and providers. By doing so, you can debunk the myth that all insurance is created equal and find the best options tailored to your specific situation.