CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Term Life Insurance: Because You Can't Buy Love, but You Can Buy Security

Discover how term life insurance can secure your family's future. Love can't be bought, but peace of mind can! Find out more now!

Understanding Term Life Insurance: A Guide to Financial Security

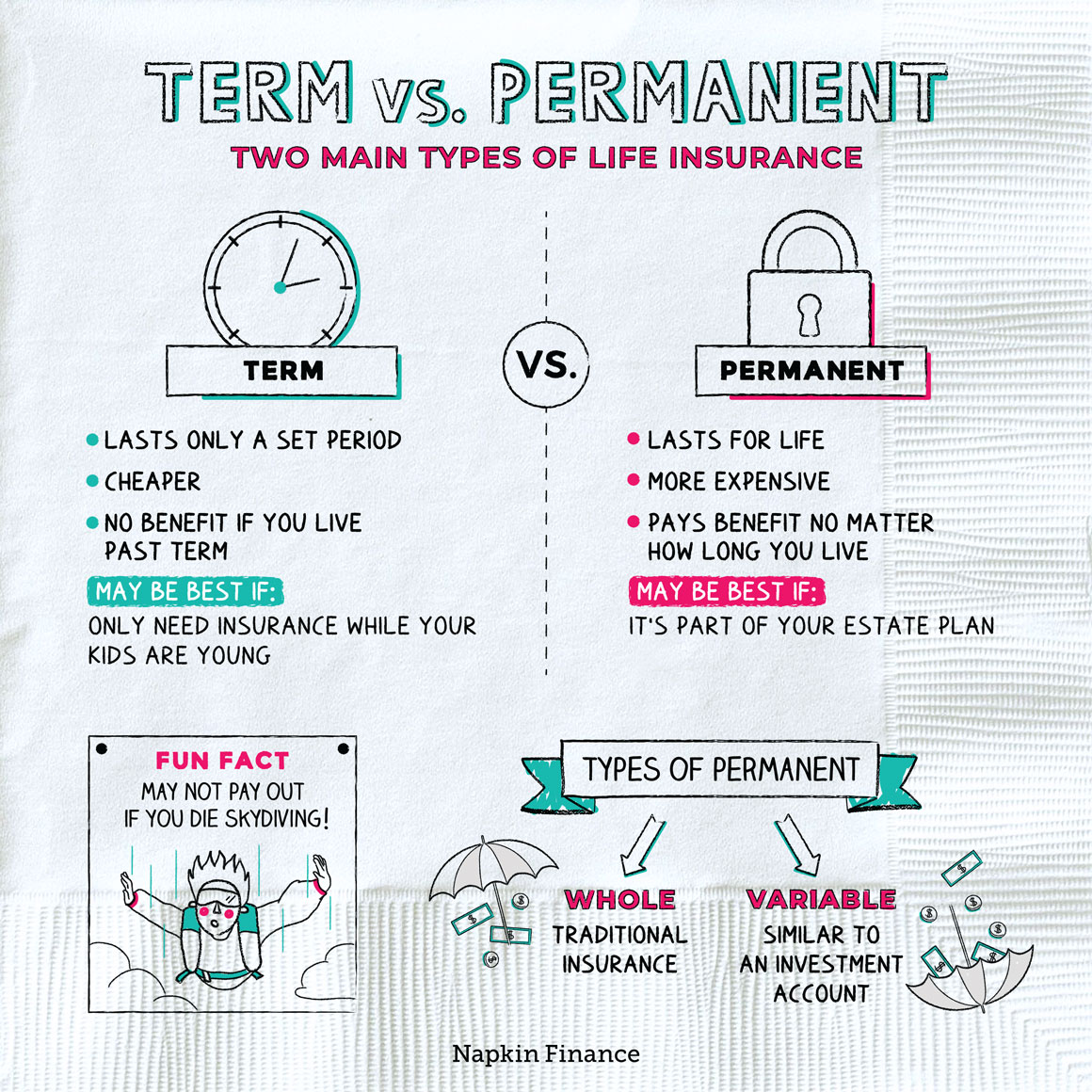

Term life insurance is a vital financial product that offers protection for a specified period, typically ranging from 10 to 30 years. This form of insurance is designed to provide a safety net for your loved ones in the event of your untimely death. Unlike whole life insurance, which accumulates cash value over time, term life insurance focuses solely on providing a death benefit. By understanding the basics of term life insurance, individuals can make informed decisions that contribute to their long-term financial security.

Choosing the right term life insurance policy involves several considerations. Here are key factors to evaluate:

- Coverage Amount: Determine how much coverage your beneficiaries would need to maintain their standard of living.

- Policy Length: Select a term length that aligns with your financial responsibilities, such as mortgage payments or children's education.

- Premium Costs: Compare quotes from multiple insurers to find a policy that fits your budget.

Is Term Life Insurance the Right Choice for You?

When considering whether term life insurance is the right choice for you, it's essential to evaluate your personal needs and financial goals. Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years, making it an attractive option for individuals seeking affordable premiums. This type of insurance can provide peace of mind by ensuring your loved ones are financially protected in the event of your untimely passing. To help you assess your situation, consider the following factors:

- Your age and health condition

- Your financial responsibilities, such as mortgage or children’s education

- Your long-term financial goals

While term life insurance is often more budget-friendly than whole life policies, it may not be suitable for everyone. If you anticipate needing coverage for your entire life or you wish to accumulate cash value, a permanent insurance policy may be more appropriate. However, for many individuals, especially younger families looking for basic protection, term life insurance can efficiently serve its purpose. Ultimately, evaluating your unique circumstances will guide you in determining if term life insurance fits your needs.

Top 5 Benefits of Term Life Insurance You Should Know

When considering financial security for your loved ones, term life insurance stands out as a reliable option. One of the primary benefits is its affordability. Compared to whole life insurance, term life policies are typically much less expensive, allowing families to secure necessary coverage without straining their budgets. This accessibility makes it easier for individuals to protect their family's financial future during critical years when they might have outstanding debts or dependents relying on their income.

Another significant advantage of term life insurance is its flexibility. Policyholders can choose the term length that best suits their needs, often ranging from 10 to 30 years. This feature allows individuals to tailor their coverage to coincide with specific financial responsibilities, such as paying off a mortgage or funding their children's education. Additionally, many policies offer the option to convert to a permanent policy later on, ensuring continued protection as life circumstances evolve.