CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Term Life Insurance: The Safety Net You're Ignoring

Discover why term life insurance is the affordable safety net you're overlooking. Secure your family's future today!

Why Term Life Insurance is the Essential Safety Net You’ve Overlooked

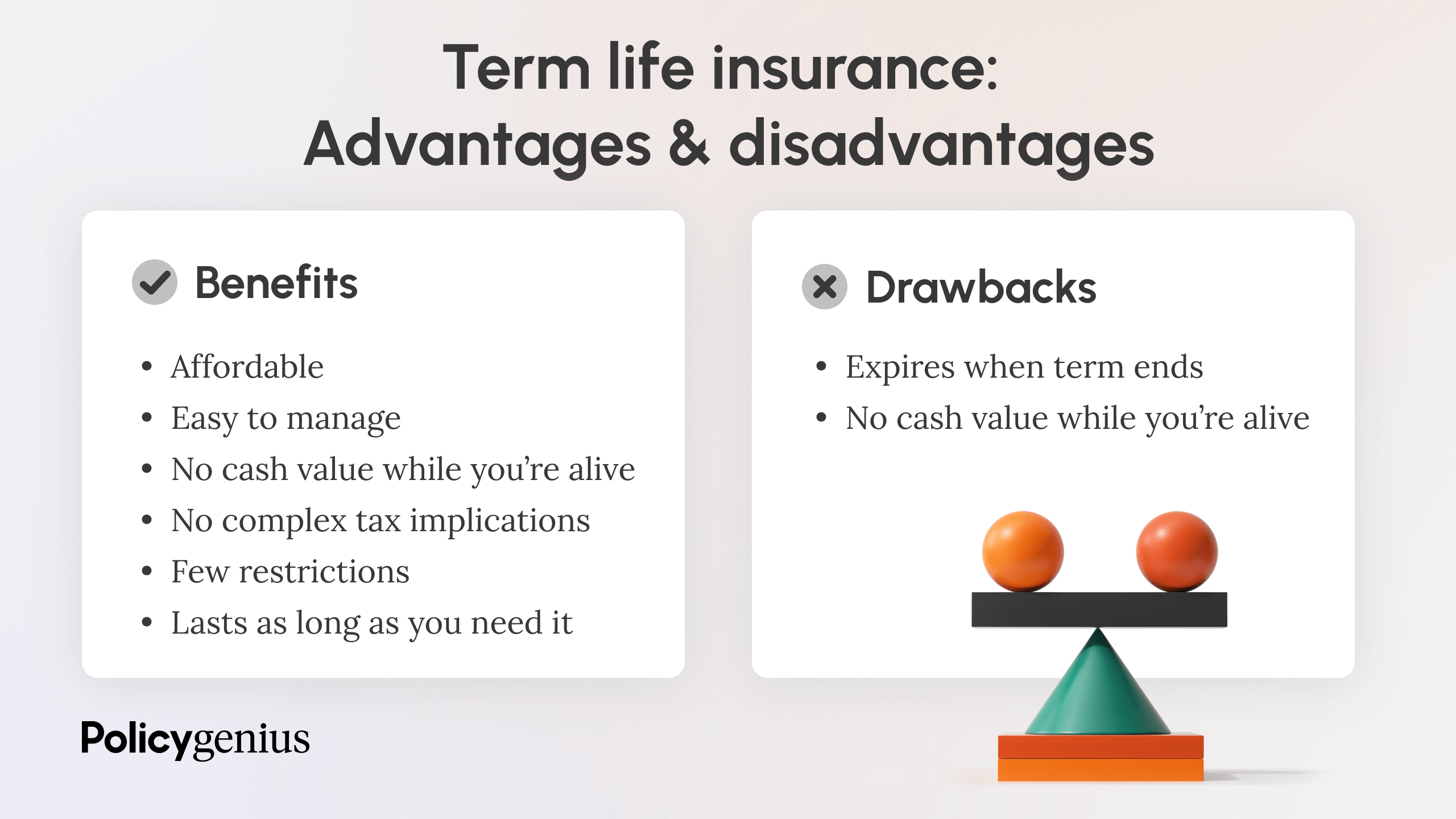

Term life insurance is often an overlooked aspect of financial planning, but it serves as a crucial safety net for individuals and families. Unlike permanent life insurance, which can be quite expensive, term life insurance provides affordable coverage for a specific period, ensuring that your loved ones are financially protected in the event of your untimely passing. With rates generally lower than their permanent counterparts, many find that they can secure substantial protection without straining their budgets. This allows families to allocate their resources towards other essential expenses, such as mortgage payments, education, and daily living costs.

Beyond affordability, term life insurance offers peace of mind during critical life stages. For young families, securing a policy while still healthy can lock in lower premiums, providing long-term benefits. In the case of unexpected events, such as job loss or rising living costs, having a solid insurance policy becomes a backstop, ensuring that dependents won't face financial ruin. As you consider your financial safety nets, remember that neglecting term life insurance can leave your loved ones vulnerable during their most challenging times.

5 Common Misconceptions About Term Life Insurance You Need to Know

When it comes to term life insurance, there are numerous misconceptions that can lead individuals to make uninformed decisions. One of the most pervasive myths is that term life insurance is only for young families. In reality, anyone can benefit from this type of policy, regardless of their life stage. It’s designed to provide coverage for a specific period, making it an excellent option for anyone with short-term financial obligations, such as a mortgage or educational expenses for children.

Another common misconception is that term life insurance is a waste of money because it doesn’t build cash value. While it’s true that term life insurance lacks a savings component, this doesn’t mean it’s not valuable. The affordability of term life insurance allows policyholders to obtain higher coverage amounts for less premium, ensuring that beneficiaries receive significant financial protection when it matters most. Understanding these nuances can help individuals make more informed choices when selecting a life insurance policy.

How Much Term Life Insurance Do You Really Need? A Comprehensive Guide

Determining how much term life insurance you really need is a crucial step in ensuring financial protection for your loved ones. To begin, consider your current financial responsibilities, which may include mortgage payments, children’s education expenses, and any outstanding debts. A common guideline is to aim for a policy that is 10 to 15 times your annual income, as this can help provide a safety net for your dependents. Additionally, factors such as the age of your children and your spouse's financial independence should influence your decision.

Next, it’s important to review your life insurance needs regularly, especially after significant life events like marriage, the birth of a child, or purchasing a home. Start by assessing your income replacement needs, which can be calculated by taking into account your depended's living expenses for at least 5 to 10 years. Moreover, consider any future costs like college tuition for your children. Creating a detailed list of these factors can help ensure that you select a term life insurance amount that adequately reflects your family's future needs.