CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Unlocking Hidden Treasures in Your Auto Insurance Policy

Discover secret savings and benefits in your auto insurance policy that could save you big! Uncover your hidden treasures now!

Understanding the Fine Print: What Your Auto Insurance Policy is Really Saying

When you first receive your auto insurance policy, the fine print can be overwhelming. It’s filled with jargon and clauses that often leave you more confused than informed. To truly understand your auto insurance policy, it’s essential to break down the key components. Start by familiarizing yourself with terms like deductibles, liability coverage, and collision coverage. Each of these elements plays a critical role in determining how much you pay out of pocket in case of an accident and how much protection you have on the road. Remember, reading the fine print before an incident occurs can save you from unpleasant surprises later.

Another crucial aspect to look out for in your auto insurance policy is the list of exclusions. Exclusions clearly specify what is not covered under your plan, which is just as important as understanding what is covered. Common exclusions might include losses due to driving under the influence or vehicle modifications that are not reported to the insurer. Make sure to take the time to read through these provisions, as they directly affect your coverage. By doing so, you arm yourself with the knowledge needed to make informed decisions, ensuring your peace of mind when you're behind the wheel.

Maximizing Your Coverage: Hidden Benefits in Your Auto Insurance Policy

Maximizing Your Coverage in auto insurance goes beyond just the basic requirements. Many drivers are unaware of the hidden benefits that their policies may offer, which can significantly enhance their financial protection in the event of an accident. For instance, some policies include features like roadside assistance and rental car reimbursement, which can save huge costs during unforeseen circumstances. It's crucial to review your policy's details carefully to ensure you're not missing out on these valuable additions.

Moreover, understanding the terms of your auto insurance can reveal options such as accident forgiveness and new car replacement. These benefits are essential for minimizing out-of-pocket expenses after an accident, particularly for new vehicle owners or those with high-value cars. By maximizing these coverage options, you can achieve a level of security that prevents unexpected financial strain. Always consult with your insurance agent to explore these hidden benefits and tailor your policy to provide the best protection possible.

Are You Missing Out? Key Questions to Ask About Your Auto Insurance Policy

When was the last time you evaluated your auto insurance policy? Many drivers make the mistake of setting it and forgetting it, which can lead to missed opportunities for better coverage or lower rates. To ensure you're getting the most out of your policy, consider asking yourself the following questions:

- Have my driving habits changed? If you've started using your car less or have recently moved, your requirements may have shifted.

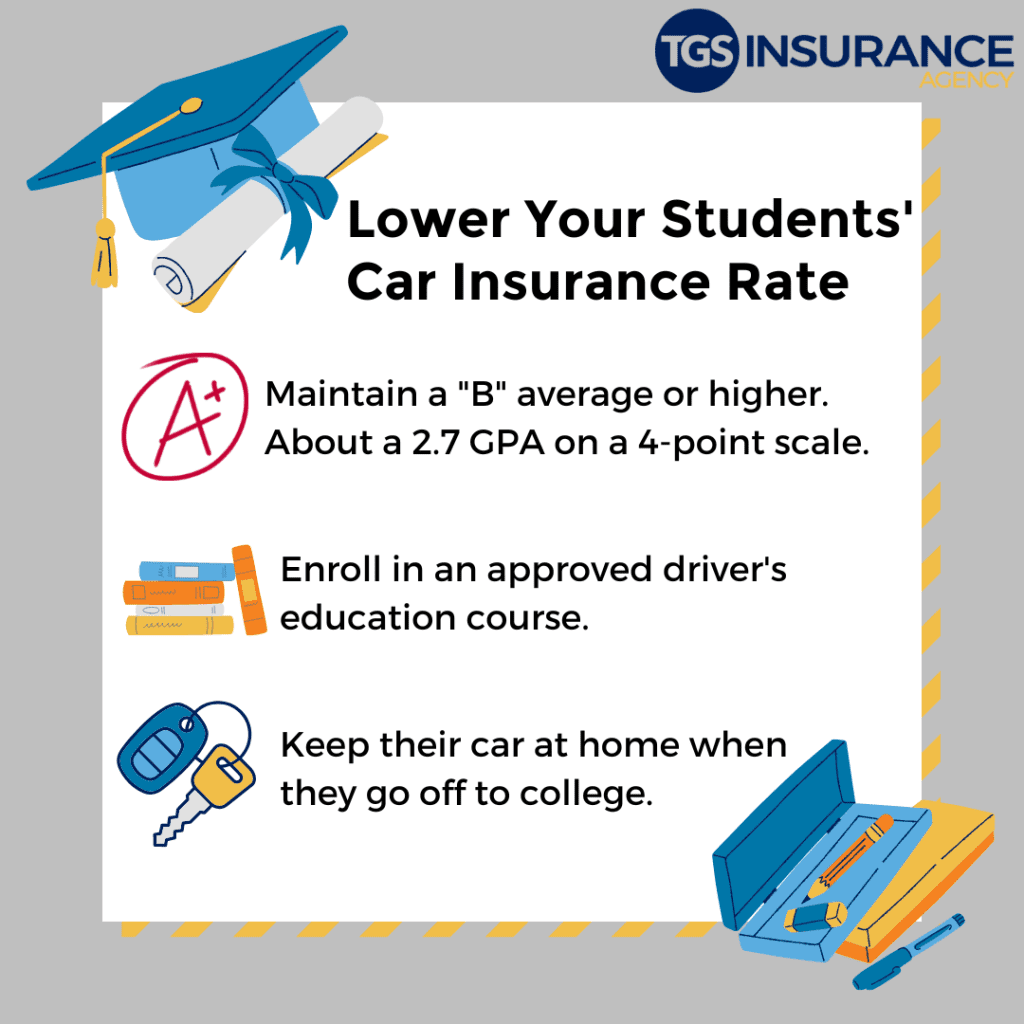

- Am I taking advantage of all available discounts? Many insurance companies offer discounts for safe driving, multiple policies, and even good student discounts.

Understanding the specifics of your auto insurance policy is crucial in protecting your investment. Here are more critical questions to ponder as you review your coverage:

- What is my deductible, and can I afford it? Knowing your deductible helps you understand your out-of-pocket expenses in case of a claim.

- Are there gaps in my coverage? Ensure you have adequate liability coverage and consider additional options like comprehensive or uninsured motorist protection.