CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

When Gold Turns Green: The Secret Life of Gold Trading

Uncover the hidden truths of gold trading and find out why this precious metal turns green. Dive into the intriguing world of gold today!

Understanding the Factors That Cause Gold to Fluctuate in Value

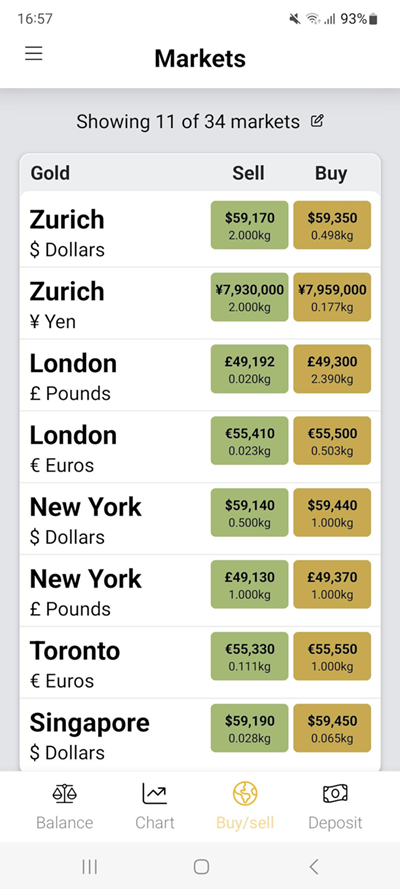

The value of gold is influenced by a myriad of factors that can cause its price to fluctuate significantly. One of the primary factors is market demand, which can be affected by various elements including economic stability, inflation rates, and investor sentiment. When uncertainty looms over the economy, investors often flock to gold as a safe-haven asset, driving up its price. Additionally, central bank policies, particularly regarding interest rates and currency strength, play a crucial role in shaping the demand for gold. For instance, lower interest rates tend to lower the opportunity cost of holding gold, thereby increasing its attractiveness.

Another critical factor affecting gold's value is the global supply chain dynamics, which includes mining production and geopolitical events. Natural disasters, regulatory changes, or political unrest in key gold-producing countries can disrupt supply, contributing to price fluctuations. Furthermore, the performance of the U.S. dollar is tightly linked to gold prices; a strong dollar typically makes gold more expensive for foreign buyers, potentially decreasing demand. Understanding these interconnected factors is essential for anyone looking to grasp the complex nature of gold valuation.

The Hidden Risks in Gold Trading: How to Protect Your Investment

Gold trading, while often seen as a safe haven during economic uncertainty, carries its own hidden risks that investors must be aware of. Market volatility can lead to rapid fluctuations in gold prices, which means that a seemingly stable investment can quickly become a source of stress. Factors such as geopolitical tensions, currency fluctuations, and even changes in interest rates can significantly impact the value of gold. Moreover, fraudulent schemes and the presence of counterfeit gold products can pose additional threats to unsuspecting investors.

To effectively protect your investment in gold trading, it is essential to adopt a proactive approach. First and foremost, always conduct thorough research before making any purchases. This includes understanding market trends, evaluating the credibility of dealers, and staying informed about legal regulations in your region. Additionally, consider diversifying your portfolio by investing in different forms of gold, such as bullion, coins, or even gold ETFs. Implementing these strategies can help mitigate risks and secure your gold investments against unforeseen market changes.

Is Gold Still the Safe Haven Asset? Analyzing Current Market Trends

As investors navigate the complexities of today's financial landscape, the question arises: Is gold still the safe haven asset? In recent years, gold has often been viewed as a buffer against economic instability, inflation, and geopolitical tensions. However, current market trends indicate a shift in investor behavior, with many turning to alternative assets such as cryptocurrencies and real estate. Despite these shifts, gold continues to maintain its historical significance, largely due to its limited supply and intrinsic value, which make it an attractive option during uncertain times.

Recent data shows that, although gold prices have experienced volatility, they retain their appeal during periods of market downturns. As inflation rises and central banks adopt loose monetary policies, gold's ability to act as a store of value becomes increasingly relevant. Additionally, investors closely monitor global events that could impact economic stability. While the landscape may evolve, the allure of gold as a safe haven asset remains strong, especially for those seeking to diversify their portfolios amidst ongoing market fluctuations.