CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

The Whimsical World of Whole Life Insurance: Protection with a Twist

Explore the quirky side of whole life insurance! Discover how protection can be fun and rewarding—your future deserves a twist!

Understanding Whole Life Insurance: The Key Benefits and Unique Features

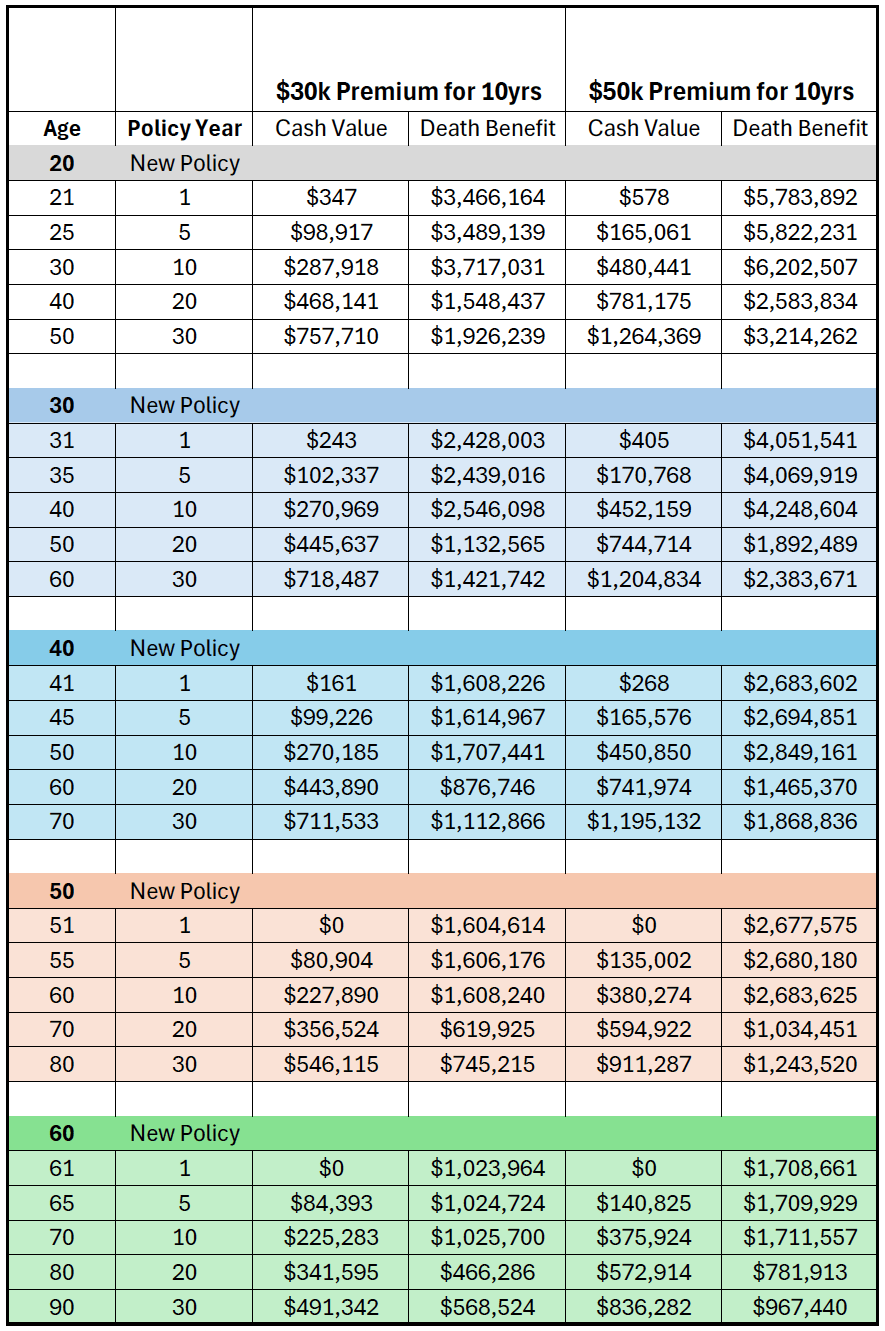

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the insured's life, as long as the premiums are paid. One of the primary benefits of whole life insurance is its ability to accumulate cash value over time. This cash value grows at a guaranteed rate and can be accessed through loans or withdrawals during the policyholder's lifetime. This feature not only serves as a financial safety net but also enhances the policyholder's overall financial strategy by offering liquidity and a source of funds in emergencies.

In addition to cash value accumulation, whole life insurance offers a number of unique features that set it apart from term life insurance. Firstly, it guarantees death benefits to beneficiaries, providing peace of mind that loved ones will be financially secure after the policyholder's passing. Secondly, whole life policies often come with a dividend option, allowing policyholders to receive dividends based on the insurer's performance, which can be used to reduce premiums, purchase additional coverage, or be taken as cash. These key benefits make whole life insurance an attractive option for those seeking a reliable and stable financial tool.

5 Common Myths About Whole Life Insurance Debunked

Whole life insurance is often misunderstood, leading to numerous myths that can misguide potential policyholders. One common myth is that whole life insurance is too expensive for the average consumer. While it is true that premiums are higher than term life insurance, the cost can be justified by the lifelong coverage and the cash value component that accumulates over time. This cash value can be accessed during the policyholder’s lifetime, making it a valuable financial resource.

Another prevalent misconception is that whole life insurance offers limited investment options. In reality, the cash value portion of these policies can grow at a guaranteed rate, and policyholders often have the ability to invest in various accounts depending on the insurer’s offerings. Additionally, many believe that whole life insurance does not pay out if the policy is canceled before the death of the insured. However, policyholders can receive a surrender value for the cash value accumulated, debunking this myth. Understanding these aspects helps potential buyers make informed decisions about their life insurance needs.

Is Whole Life Insurance Right for You? Discover the Unexpected Benefits

When considering the question, Is Whole Life Insurance Right for You?, it’s essential to recognize that it goes beyond mere death benefits. Whole life insurance offers a cash value component that accumulates over time, providing policyholders with a unique financial asset. Unlike term life insurance, which offers coverage for a set period, whole life insurance guarantees lifelong protection. This can be particularly beneficial for those looking to ensure their family’s financial security, potentially covering final expenses or providing an inheritance. Additionally, the cash value can be accessed through loans or withdrawals, granting you liquidity in times of need.

Moreover, whole life insurance has unexpected benefits that may align with your financial goals. For instance, the premiums you pay can qualify for dividends, depending on the performance of the insurance company. This can mean receiving a portion of your premium back, which can be reinvested, used to pay premiums, or taken as cash. Furthermore, the growth of the cash value is tax-deferred, allowing your money to work harder for you over time. Before deciding if whole life insurance is suitable, it’s wise to consult with a financial advisor to explore how it can complement your overall financial strategy.