CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Whole Life Insurance: The Forever Policy You Didn’t Know You Needed

Unlock financial security with whole life insurance—discover why this lasting policy is your hidden gem for peace of mind!

Understanding Whole Life Insurance: Key Benefits and Features

Whole life insurance is a type of permanent life insurance that offers financial protection for your loved ones while also building a cash value over time. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance remains in effect for your entire lifetime, as long as premiums are paid. One of the primary benefits of this policy is the guaranteed death benefit, which ensures that your beneficiaries receive a predetermined amount upon your passing. This can provide peace of mind, knowing that your family will be financially secure in the event of your death.

Moreover, whole life insurance policies come with a unique savings component that accumulates cash value, which can be borrowed against or withdrawn for various financial needs. The cash value grows at a steady, guaranteed rate, allowing policyholders to build savings over time. Additionally, whole life insurance premiums generally remain level throughout the policyholder's life, making budgeting easier. To summarize, here are some key features of whole life insurance:

- Guaranteed death benefit

- Cash value accumulation

- Stable premium payments

- Potential dividends from mutual insurance companies

Is Whole Life Insurance Right for You? Frequently Asked Questions

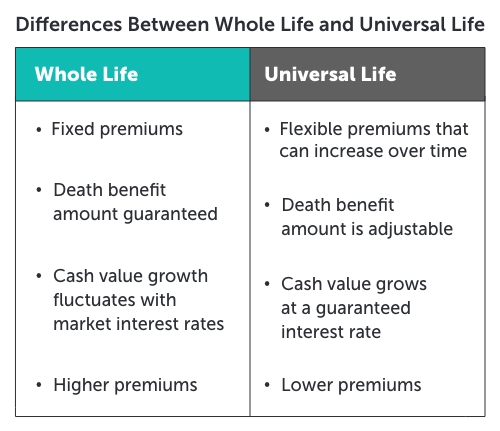

Determining whether whole life insurance is right for you involves considering your financial goals, risk tolerance, and the benefits this type of policy offers. Whole life insurance provides lifelong coverage, and it accumulates cash value over time, making it an attractive choice for those looking for both protection and savings. Key benefits include fixed premiums, guaranteed death benefits, and the ability to borrow against the cash value. However, it’s important to note that these policies often come with higher premiums compared to term life insurance, which may not align with everyone’s budget.

Many potential policyholders often have questions about whole life insurance. Here are some frequently asked questions:

- What happens to the cash value? The cash value grows at a guaranteed rate and can be withdrawn or borrowed against, but doing so may reduce your death benefit.

- Is whole life insurance a good investment? While it provides insurance coverage, the returns on cash value may be lower compared to other investment options.

- Can I change my policy later? Some policies offer flexibility, allowing you to adjust your coverage depending on your needs, though changes may affect your premiums.

The Long-Term Value of Whole Life Insurance: A Comprehensive Guide

Whole life insurance is often viewed simply as a safety net for your loved ones, but its benefits extend far beyond that initial purpose. This permanent life insurance policy not only provides a death benefit but also builds cash value over time. The long-term value of whole life insurance lies in its ability to offer financial stability and security throughout an individual's life. Unlike term policies, which expire after a set duration, whole life insurance remains active as long as premiums are paid. This feature makes it a valuable asset for long-term financial planning.

In addition to its death benefit, whole life insurance is unique because it integrates the cash value component, which grows at a guaranteed rate. As policyholders faithfully pay their premiums, they accumulate a cash reserve that can be borrowed against or withdrawn. This dual benefit creates opportunities for wealth generation and financial flexibility. Moreover, since the growth of cash value is tax-deferred, it offers an appealing strategy for long-term investment besides traditional savings accounts or retirement funds. Understanding how to leverage the long-term value of whole life insurance can lead to significant financial advantages throughout your life.