CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Whole Life Insurance: The Lifetime Commitment You Didn't Know You Needed

Discover why whole life insurance is the lifelong commitment that could secure your family's future. Don't miss out on this essential coverage!

What is Whole Life Insurance and How Does It Work?

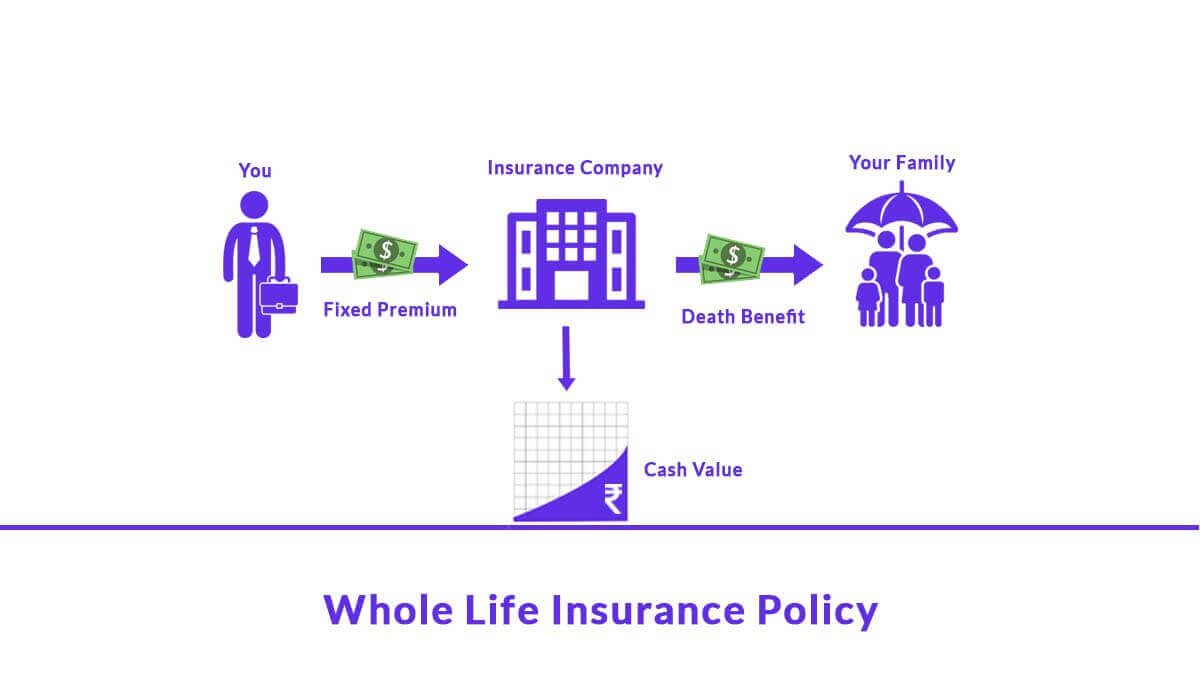

Whole Life Insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as the premiums are paid. Unlike term life insurance, which offers coverage for a specific period, whole life insurance builds cash value over time, making it a valuable financial asset. This cash value accumulates on a tax-deferred basis, allowing policyholders to borrow against it or even withdraw from it, providing liquidity and flexibility. It's essential to understand that the premium payments for whole life insurance are generally higher than those of term policies, reflecting the lifelong coverage and cash value component.

When you purchase a whole life insurance policy, you enter into a contract with the insurance company that stipulates your premium payments, coverage amount, and the policy's terms. Most whole life policies offer a level premium, meaning the payment remains consistent throughout your life. This predictability can assist in budgeting, making it easier to plan your finances. Furthermore, upon the policyholder's death, the beneficiaries receive a death benefit that is typically tax-free, ensuring financial security for loved ones. Understanding how whole life insurance works can empower individuals to make informed decisions about their financial futures.

Top 5 Benefits of Whole Life Insurance You Didn't Know About

Whole life insurance is often perceived merely as a financial safety net for your loved ones after your passing. However, the benefits of whole life insurance extend far beyond just death benefits. One significant advantage is the cash value accumulation that grows over time. Unlike term life insurance, the premiums you pay for whole life insurance build up a cash value that you can borrow against or withdraw during your lifetime. This can provide you with a financial resource for emergencies, investments, or even funding your retirement.

Another lesser-known benefit is that whole life insurance can serve as a stable investment option. The cash value grows at a guaranteed rate set by the insurance company, and many policies also pay dividends depending on the insurer's performance. This combination offers a sense of security and can act as a hedge against market volatility, making it a valuable addition to your financial portfolio. In addition, the death benefit is generally tax-free, providing an additional layer of financial planning for your heirs.

Is Whole Life Insurance Worth the Investment for Your Financial Future?

When considering financial products for long-term security, whole life insurance often comes under scrutiny. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance offers lifelong protection and builds cash value over time. This dual benefit can be particularly appealing for those seeking a stable investment vehicle in addition to a safety net for their loved ones. However, it's crucial to assess whether the high premiums associated with whole life policies align with your overall financial goals and budget.

One significant advantage of whole life insurance is its ability to accumulate cash value, which can be borrowed against or withdrawn later in life. This feature provides policyholders with a sense of security and flexibility as they plan for future expenses, such as college tuition or retirement. Nonetheless, it's essential to weigh these benefits against potential drawbacks, including lower returns compared to other investment options and the impact of policy fees. Ultimately, the decision on whether whole life insurance is worth the investment should stem from a thorough evaluation of your personal financial situation and long-term objectives.