CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Why Renters Insurance is the Best Relationship You Never Knew You Wanted

Unlock peace of mind with renters insurance—discover why it's the ultimate safety net for you and your valuables!

5 Surprising Benefits of Renters Insurance You Didn’t Know Existed

When renting a home or apartment, renters insurance often takes a backseat in many people’s minds. However, there are several surprising benefits of this valuable policy that go beyond simple property protection. For instance, did you know that having renters insurance can provide liability coverage? This means that if someone gets injured in your rented space and files a claim against you, your policy can help cover those expenses. This safety net can be essential in preventing significant financial upheaval.

Another lesser-known advantage of renters insurance is that it can cover additional living expenses in case of a covered loss. If your rented home becomes uninhabitable due to a disaster, like a fire or severe water damage, your policy may pay for temporary accommodation, food, and other necessary living expenses while you get back on your feet. This ensures that you won't have to bear the burden of extra costs while you deal with the aftermath of an unexpected event, making renters insurance a smart investment for everyday peace of mind.

How Renters Insurance Can Protect Your Relationships and Belongings

Renters insurance is not just a safety net for your belongings; it can also play a crucial role in maintaining healthy relationships. Imagine you host a gathering at your apartment, and an unexpected incident occurs, like a guest accidentally breaking a valuable item. Without renters insurance, you may feel financially burdened and might end up straining your friendship over an unavoidable accident. However, having the right coverage allows you to recover the cost, reassuring both you and your guests that accidents happen, but relationships can remain intact.

Moreover, renters insurance extends its protective embrace to your personal relationships as well. In the event of a theft or damage to your possessions, the emotional distress can put pressure on those close to you. Understanding that you are financially safeguarded can alleviate some of this stress, enabling you to focus on rebuilding and moving forward rather than dwelling on losses. This peace of mind fosters resilience and support, essential components for strong bonds with family and friends during challenging times.

Is Renters Insurance Worth It? Here’s What You Need to Know

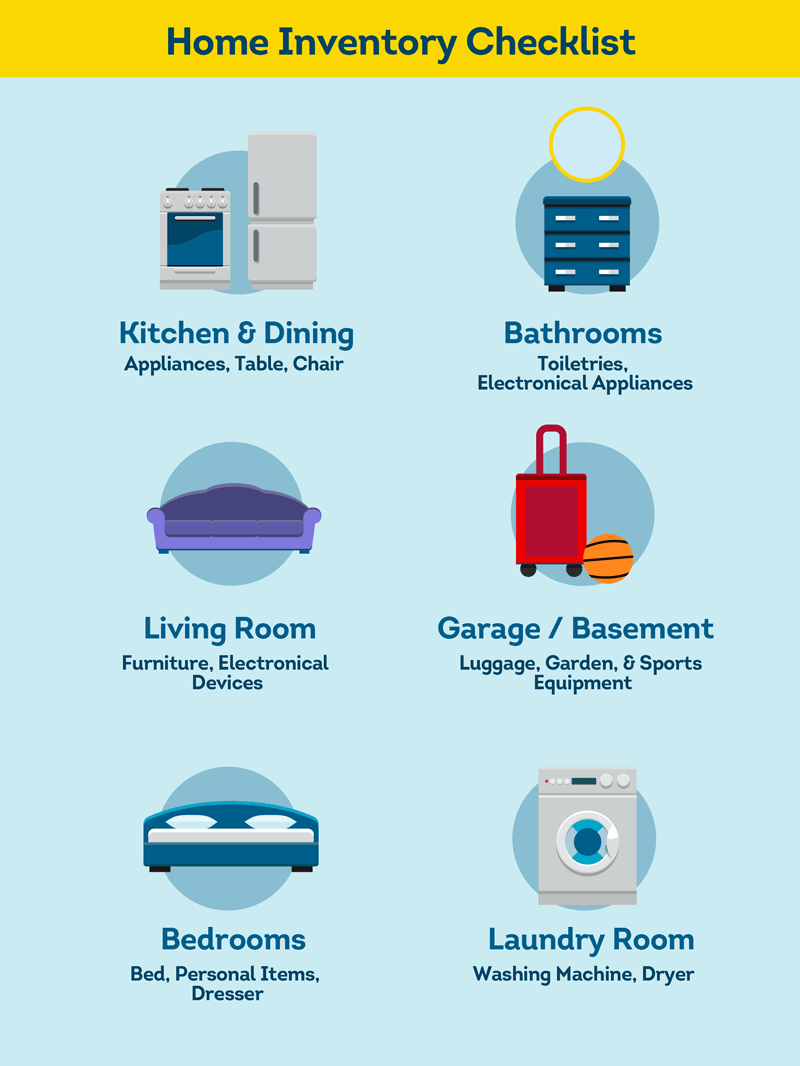

When evaluating whether renters insurance is worth it, it's important to consider the cost of potential losses versus the expense of coverage. Renters insurance typically costs between $15 and $30 per month, which is a small price to pay for peace of mind. In the event of a fire, theft, or even water damage, having this type of insurance can safeguard your personal belongings, including electronics, furniture, and clothing. Without it, you risk facing the financial burden of replacing these items out-of-pocket, which can become overwhelming.

Furthermore, many landlords require tenants to carry renter's insurance as part of the lease agreement, providing an additional layer of protection for both parties. This type of insurance often extends beyond just personal belongings; it also covers liability in case someone gets injured in your rental unit. Understanding these aspects can help you make an informed decision. Here are some key benefits of renters insurance to consider:

- Coverage for personal property damage or loss.

- Liability protection in case of accidents.

- Affordable monthly premiums.