CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Why Renters Insurance is the Overlooked Sidekick Every Tenant Needs

Discover why renters insurance is the ultimate safety net for tenants! Don’t overlook this essential protection for your peace of mind.

The Essential Guide to Renters Insurance: Protecting Your Valuables

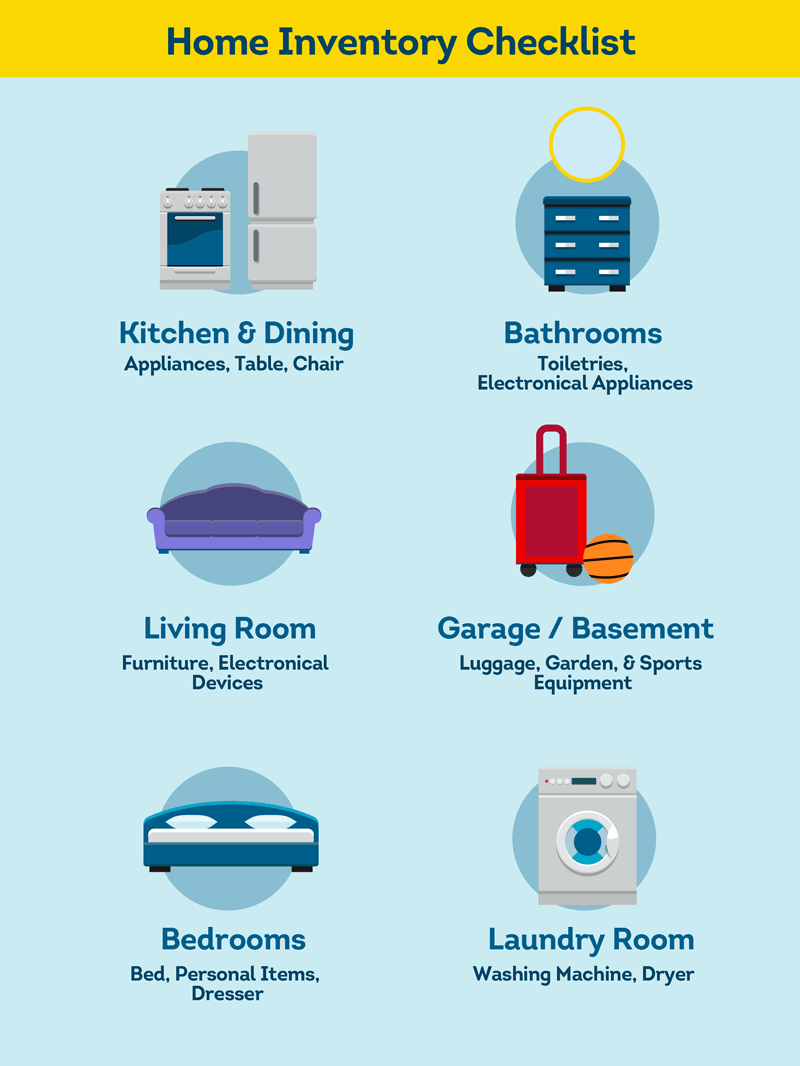

Renters insurance is a vital component of financial security for anyone living in a rented property. While many tenants believe that their landlord's insurance will cover their personal belongings, this is a common misconception. Renters insurance not only protects your valuable items, such as electronics, furniture, and clothing, but it also provides liability coverage in case someone is injured while on your premises. By investing in a policy, you can ensure that your possessions are safeguarded against unforeseen events like theft, fire, or natural disasters.

When shopping for renters insurance, it's crucial to consider the following key factors:

- Coverage Types: Understand the difference between actual cash value and replacement cost coverage. The former deducts depreciation from the value of your belongings, while the latter covers the full cost to replace them.

- Policy Limits: Evaluate the maximum amount your insurance will pay for specific items, such as jewelry or electronics, and consider increasing these limits if necessary.

- Deductibles: Higher deductibles typically lower your premium but may result in higher out-of-pocket costs during a claim.

Top 5 Reasons Why Renters Insurance is a Must-Have for Every Tenant

Renters insurance is essential for every tenant for several reasons. Firstly, it provides financial protection against unforeseen events such as theft, fire, or natural disasters. Many renters believe that their landlord’s insurance will cover their personal belongings, but this is a common misconception. In reality, the landlord's policy only covers the building itself, leaving tenants susceptible to loss. By having renters insurance, individuals can ensure they are financially backed even in the face of disasters.

Secondly, renters insurance often comes with liability coverage, protecting tenants from potential lawsuits. If a guest is injured in a rental property, having renters insurance can cover medical costs or legal fees that may arise. Moreover, the affordability of renters insurance adds to its appeal; with policies averaging around $15 to $30 per month, it is a minimal expense compared to the peace of mind it brings. In conclusion, acquiring renters insurance is a small but crucial step that ensures every tenant is fully protected.

Is Renters Insurance Worth It? Debunking Myths and Misconceptions

When considering whether renters insurance is worth it, it’s essential to address common myths and misconceptions that often cloud decision-making. Many people believe that their landlord's insurance covers their personal belongings, but this is not the case. Landlord insurance typically protects the physical structure of the property, leaving renters vulnerable to loss or damage from theft, fire, or other disasters. According to experts, having renters insurance can provide peace of mind and financial security, especially for those with valuable possessions.

Another misconception is that renters insurance is too expensive. In reality, the cost is often minimal compared to the protection it offers. On average, renters can expect to pay as little as $15 to $30 per month for coverage. For such an affordable premium, renters can protect their personal property, liability, and even temporary living expenses in case of a covered event. Overall, weighing the risks of being uninsured against the low cost of a policy clearly supports the argument that renters insurance is not just worth it, but essential.