CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

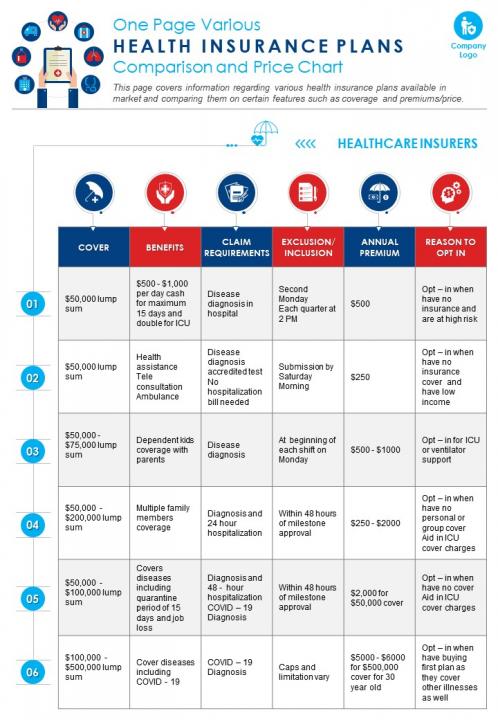

Insurance Showdown: Why Settle for Less?

Uncover the truth about insurance! Discover why settling for less could cost you dearly in our ultimate Insurance Showdown. Read more!

Top 5 Reasons to Avoid Common Insurance Pitfalls

When it comes to protecting your assets and loved ones, navigating the world of insurance can be daunting. It's crucial to be aware of the common insurance pitfalls that can lead to inadequate coverage or financial loss. One significant reason to avoid these pitfalls is the risk of insufficient coverage. Many policyholders underestimate their insurance needs and end up with policies that don't fully cover their assets or liabilities, which can be devastating in the event of a claim.

Another important reason to steer clear of insurance pitfalls is the potential for increased premiums. Failing to understand the terms and conditions of your policy can lead to misunderstandings that may result in higher costs down the line. Additionally, neglecting to review your insurance policy regularly can lead to gaps in coverage as your circumstances change. By being proactive and informed, you can avoid these common traps and secure the financial protection you need.

What to Look for in Your Insurance Policy: A Comprehensive Guide

When selecting an insurance policy, it’s essential to consider several critical factors to ensure you’re adequately covered. First, review the coverage limits to determine if they align with your needs; insufficient coverage can leave you vulnerable in the event of a loss. Additionally, examine the policy’s deductible, which is the amount you must pay out-of-pocket before your insurance kicks in. A high deductible might lower your premium, but it can also lead to significant costs during a claim. Finally, check the policy for any exclusions that could jeopardize your coverage, ensuring you’re aware of situations that the policy won’t cover.

Another crucial aspect to consider is the insurer's financial stability. Researching the company’s ratings from independent agencies can give you insight into their ability to pay claims when needed. It's also wise to investigate the customer service reputation of the insurer, as responsive support can expedite the claims process and make for a smoother experience during stressful times. Lastly, don’t forget to read the terms and conditions carefully—understanding the fine print can help you avoid unpleasant surprises later on and empower you to make informed decisions about your choice of coverage.

Insurance Myths Debunked: Are You Getting the Coverage You Need?

When it comes to insurance, myths abound, leading many to make poor decisions about their coverage. One common misconception is that a higher premium means better coverage. In reality, the level of coverage is determined by the policy details, not the price tag. Understanding your policy and what it specifically covers is crucial to ensure you have the protection you need. Always read the fine print and consult with an insurance expert to clarify any doubts you may have.

Another prevalent myth is that all insurance providers are the same, but this is far from the truth. Different insurers offer varying levels of service and coverage options, which can significantly impact your claims experience. To avoid being caught off guard, it’s essential to shop around and compare policies carefully. Look for customer reviews and ratings to get a sense of each company’s reliability and responsiveness. Being informed will empower you to make the best choice for your coverage needs.