CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Travel Insurance: Your Unexpected Lifesaver Abroad

Discover how travel insurance can save your trip from unexpected disasters and give you peace of mind while exploring the world!

Top 5 Reasons You Need Travel Insurance Before Your Next Trip

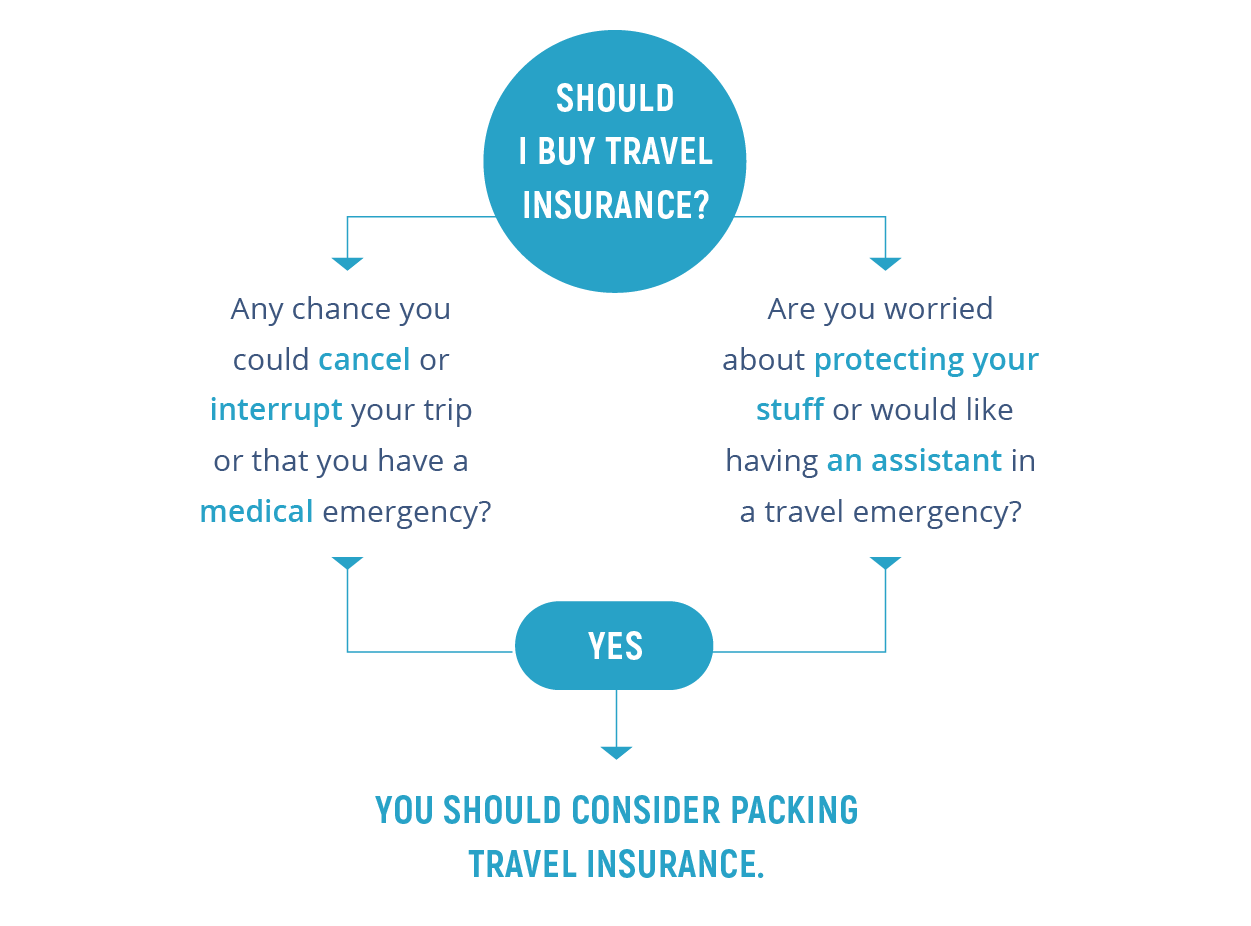

Travel insurance is often seen as an optional expense, but it can be a lifesaver in unforeseen circumstances. First and foremost, it provides financial protection in case of trip cancellations. Whether it's due to illness, natural disasters, or sudden emergencies, having insurance can help you recover non-refundable costs. Secondly, it covers unexpected medical expenses that can arise while traveling abroad, ensuring you have access to necessary healthcare without breaking the bank.

Additionally, travel insurance can offer coverage for lost or stolen belongings, giving you peace of mind during your adventures. Thirdly, it includes emergency evacuation services, which can be crucial in remote areas or during natural disasters. Lastly, many policies offer 24/7 assistance, providing support when you need it most. With these benefits, investing in travel insurance is a smart decision to make your next trip worry-free.

What Does Travel Insurance Cover? A Complete Guide

Travel insurance is a crucial aspect of planning your trip, as it provides peace of mind by covering various unforeseen circumstances. Most policies include trip cancellation, which reimburses you for non-refundable expenses if you need to cancel your trip for a covered reason, such as illness or a family emergency. Additionally, travel insurance covers trip interruptions that may occur due to unexpected events, ensuring you get your money back for any unused accommodations or activities.

Another important coverage aspect is medical expenses. If you fall ill or get injured while traveling, travel insurance can help cover the costs of medical treatment, including hospital visits and emergency evacuations. Other common coverages include lost luggage, which compensates you for belongings that are delayed, lost, or stolen, and travel assistance services, which provide support during emergencies. Understanding what your policy includes will help you choose the right coverage for your adventures.

What to Do if You Need to Use Your Travel Insurance Abroad?

If you find yourself in a situation where you need to use your travel insurance abroad, the first step is to review your policy. Familiarize yourself with the coverage details, including what types of emergencies are covered and any necessary procedures to follow. In many cases, insurance providers require you to contact them as soon as possible to report the issue. Document everything by taking notes and keeping receipts, as this will be crucial when you file your claim.

Once you've reviewed your policy and contacted your travel insurance provider, locate nearby medical facilities or services, depending on your need. Make sure to have your insurance card or policy number accessible, as you'll likely need to provide this information to the medical provider. Additionally, keep a copy of all medical records and receipts related to your treatment. This documentation is vital for a successful claim process once you return home.