CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

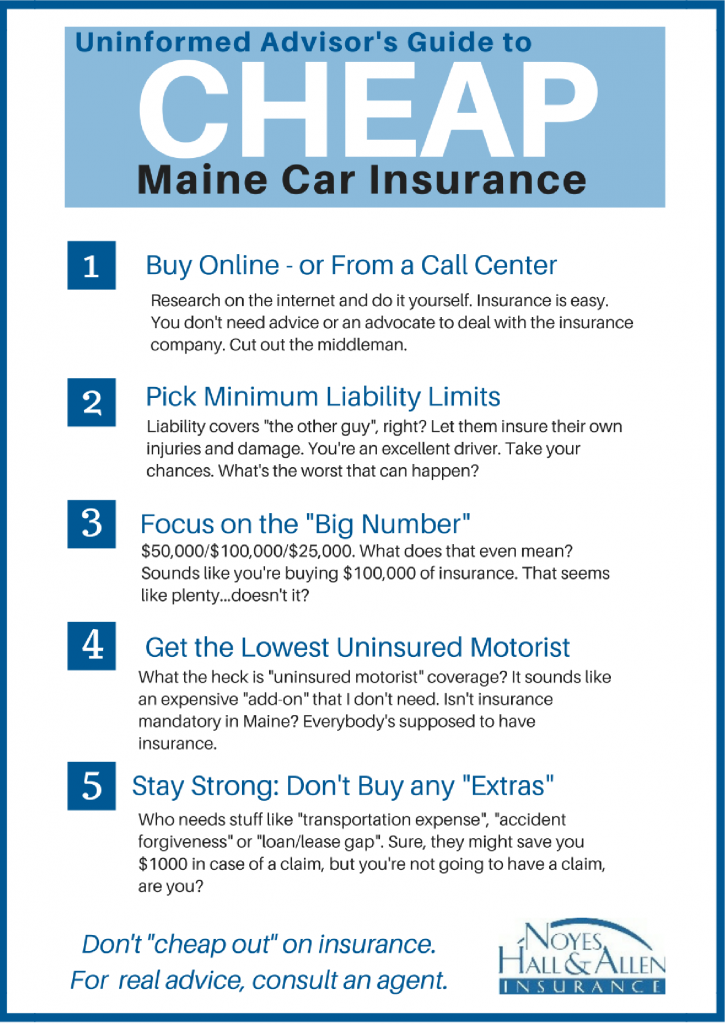

Cheap Insurance: Bargain Hunting Without the Risk

Discover how to find affordable insurance without compromising coverage. Start saving big today with our expert tips and tricks!

Understanding the Basics of Affordable Insurance: What You Need to Know

Understanding the basics of affordable insurance is crucial for anyone looking to protect themselves and their assets without breaking the bank. Affordable insurance typically includes various types of coverage, such as health, auto, home, and life insurance. To find the best options, it's essential to compare policies and consider the coverage limits, deductibles, and premiums. Many providers offer customizable plans that allow you to adjust coverage to fit both your needs and budget.

When searching for affordable insurance, keep in mind the importance of understanding terms and conditions. Look for factors such as:

- Customer reviews: Gauge the reliability of the insurance provider through feedback.

- Network availability: Ensure the provider's network meets your needs, especially for health insurance.

- Discount opportunities: Many companies offer discounts for bundling policies or maintaining a good driving record.

By staying informed and proactive in your search, you can secure affordable insurance that suits your lifestyle.

Top 5 Tips for Finding Cheap Insurance Without Sacrificing Coverage

Finding affordable insurance that doesn't compromise on coverage can seem daunting, but with the right strategies, it's entirely achievable. Tip #1: Start by comparing quotes from various insurance providers. Utilize online comparison tools to get an overview of different rates and coverage options available in your area. This practice can potentially save you hundreds of dollars annually and help you identify plans that offer the best value for the coverage you need.

Tip #2: Don’t hesitate to inquire about discounts. Many insurers offer various discounts based on factors such as bundling policies, having a good driving record, or being a member of certain organizations. Tip #3: Consider adjusting your deductible. A higher deductible can lower your premium, but ensure it's an amount you can afford in case of a claim. Following these tips can significantly enhance your chances of finding cheap insurance without sacrificing essential coverage.

Is Cheap Insurance Worth It? Evaluating Risks and Rewards

When considering cheap insurance, it's essential to assess both the risks and rewards associated with lower premiums. While affordable plans may seem appealing at first glance, they often come with significant drawbacks. For instance, many cheaper policies come with higher deductibles, limited coverage options, and exclusions that may leave policyholders vulnerable in critical situations. Therefore, understanding the total cost of ownership, including potential out-of-pocket expenses, is crucial in making an informed decision.

On the other hand, cheap insurance can provide a safety net for individuals or families on a tight budget. It ensures that basic coverage needs are met, allowing one to mitigate losses from unforeseen events without incurring overwhelming financial strain. To evaluate whether cheap insurance is right for you, consider the following factors:

- Your specific coverage needs

- Your financial situation

- The likelihood of making a claim