CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Discounts That Drive Your Premium Down

Unlock hidden savings! Discover discounts that lower your premiums and boost your wallet. Don’t miss out on smart money moves!

Unlocking Hidden Savings: How to Find Discounts That Lower Your Premium

Finding discounts that lower your premium can seem like a daunting task, but with a little research and strategy, you can unlock hidden savings. Start by reviewing your current policy and checking with your insurance provider about any available discounts. Many insurers offer discounts for things like bundling multiple policies, maintaining a good driving record, or even completing defensive driving courses. Every little bit counts, so make sure to ask the right questions and explore all options available to you.

In addition to direct discounts from your insurance provider, consider shopping around to compare rates across different companies. Websites that aggregate insurance quotes can help you find better deals tailored to your specific needs. Don't forget to look for discounts for loyalty programs, affiliations, or membership in certain organizations. Remember, being proactive in your search can lead to substantial savings on your premiums!

10 Essential Discounts You Might Be Missing to Reduce Your Insurance Costs

Reducing your insurance costs can significantly impact your monthly budget, yet many policyholders overlook essential discounts. One of the most commonly missed opportunities is the multi-policy discount. Bundling your auto and home insurance can lead to substantial savings, typically ranging from 10% to 25%. Additionally, inquire about discounts for being a safe driver; many insurance companies reward those with a clean driving record with lower rates. Other common discounts include good student discounts for young drivers and homeowners associations which may provide additional reductions.

It's important to regularly review the discounts offered by your insurer, as they can change frequently. Don’t forget to ask about loyalty discounts for long-term customers and potential savings for having a security system installed in your home. If you work in specific professions, such as education or healthcare, you might be eligible for professional discounts as well. Always take time to negotiate with your insurance provider; even if you don’t qualify for a particular discount, they may still offer you a better rate upon request. By being proactive and informed, you can uncover these essential discounts that will help keep your insurance costs manageable.

Are You Paying Too Much? Discover Discounts That Can Drive Your Premium Down

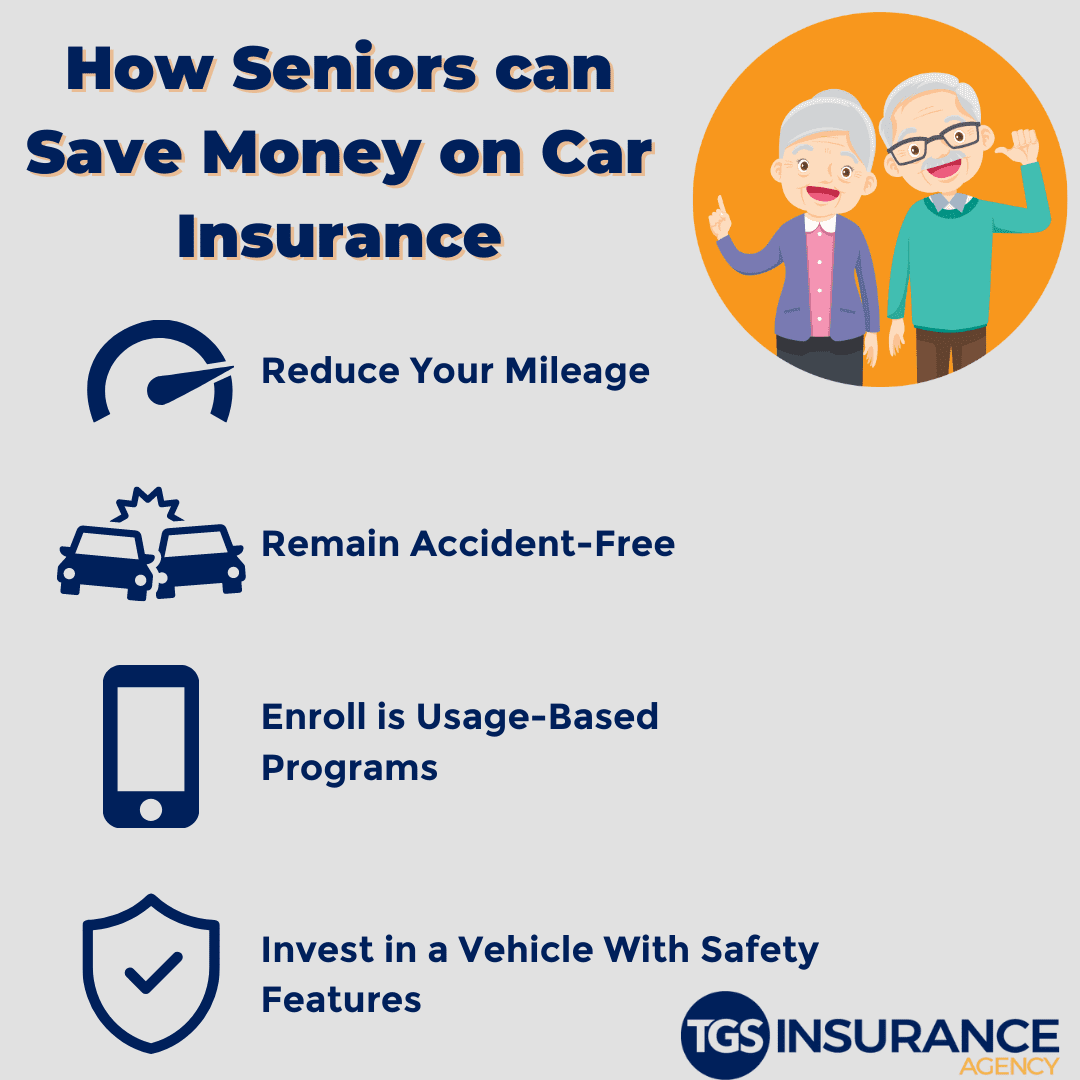

In today's economy, paying too much for insurance premiums can significantly impact your budget. Whether it's auto, home, or health insurance, many consumers are unaware of the various discounts available to them. To start saving, consider reviewing your current policy and comparing it to other options in the market. Many providers offer discounts for bundling multiple policies, maintaining a good driving record, or even for being a member of certain organizations. Don't underestimate how these small adjustments can lead to substantial savings.

Another effective way to drive your premium down is by taking advantage of loyalty programs and promotional discounts. For instance, some insurers provide special rates for long-term customers or incentives for claims-free years. Additionally, consider requesting a discount for greater safety features in your vehicle or home, as these can also lower your risk profile in the eyes of insurers. By being proactive and informed, you can ensure that you aren't paying too much for essential coverage.