CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Ditch the Guesswork: Your Insurance Comparison Journey Starts Here

Unlock the secrets to smart insurance choices! Start your hassle-free comparison journey and save big today!

Understanding Insurance Types: What You Need to Know Before Comparing

When it comes to understanding insurance types, it is crucial to recognize the various categories available to consumers. Each type of insurance serves a unique purpose and covers different aspects of life, from health and auto to renters and life insurance. By familiarizing yourself with these categories, you can make informed decisions about what coverage suits your needs best. Here are some common types of insurance:

- Health Insurance: Covers medical expenses.

- Auto Insurance: Protects against vehicle-related damages.

- Homeowners Insurance: Safeguards your home, possessions, and liability.

- Life Insurance: Provides financial support to beneficiaries after death.

Before comparing insurance options, it's important to assess your personal circumstances and the risks you face. Consider factors such as your health, lifestyle, and financial situation. For example, if you have dependents, life insurance might be a higher priority for you. When evaluating policies, it’s essential to not only look at premiums but also at coverage limits, deductibles, and exclusions. Remember, the cheapest policy isn't always the best; look for comprehensive coverage that meets your unique needs.

5 Essential Tips for an Effective Insurance Comparison Journey

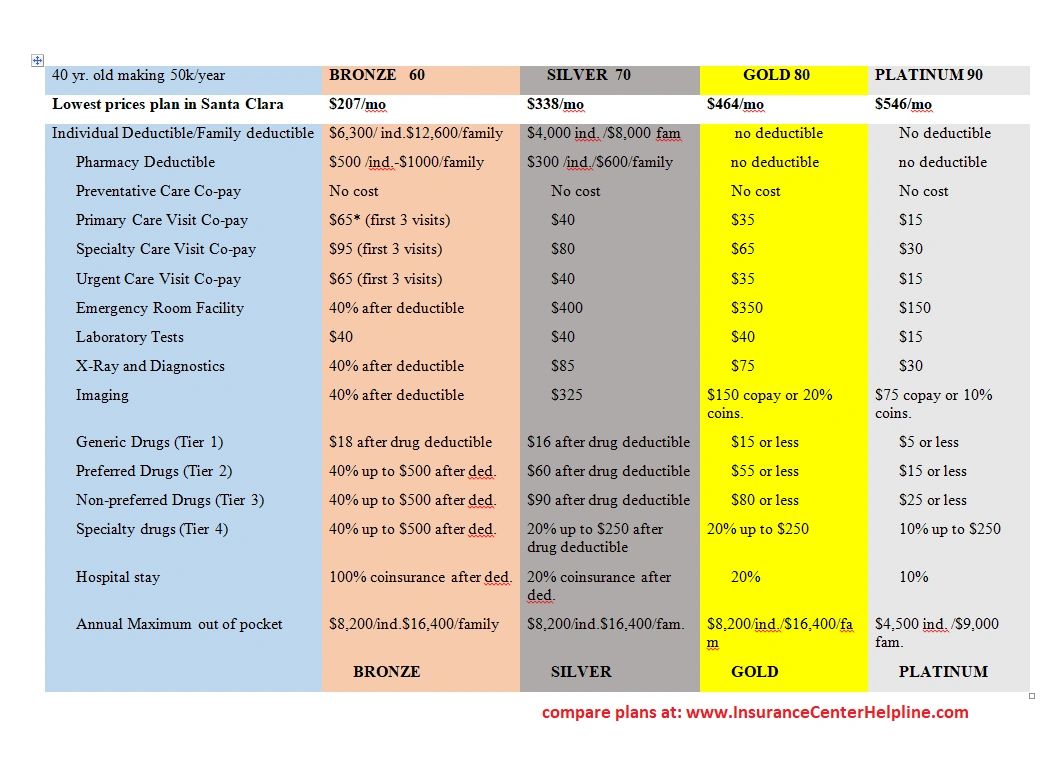

When embarking on your insurance comparison journey, one of the most essential tips is to clearly define your coverage needs. Consider what types of insurance you are looking for, such as health, auto, or home insurance, and assess the specific features required for your situation. For example, if you're comparing health insurance, think about factors like network providers, coverage limits, and out-of-pocket costs. Creating a checklist can help streamline this process and ensure that you don't overlook important details.

Next, it's vital to gather multiple quotes for an accurate comparison. Use online tools or contact insurance agents to request quotes from a variety of providers. When comparing, pay close attention to premium costs, deductibles, and the extent of coverage offered. Organizing this information into a comparison chart can make it easier to spot the best options available. Remember, the cheapest policy may not always be the best; focus on the value and level of coverage that suits your needs.

Is Your Insurance Policy Meeting Your Needs? Key Questions to Ask

When evaluating whether your insurance policy is meeting your needs, it’s essential to ask yourself some key questions. First, consider if your current coverage accurately reflects your lifestyle changes and financial situation. Have you recently bought a home, changed jobs, or expanded your family? Major life events often necessitate adjustments in your policy. It’s also crucial to scrutinize the types and amounts of coverage provided. Does it cover all the risks you might face, or are there gaps that could leave you vulnerable?

Next, you should assess the affordability of your insurance policy. Are the premiums manageable without sacrificing essential expenses? Evaluate whether the deductible amounts are reasonable for your financial situation. Additionally, inquire about any discounts or bundling options available to potentially lower your costs. As you contemplate these aspects, remember to compare your policy against others in the market to ensure you're not just compliant, but also getting the best value for your investment.