CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Ditching Premiums: Clever Ways to Slash Your Auto Insurance Costs

Unlock savings with clever tips to slash your auto insurance costs—ditch those premiums today! Discover how to save big!

Top 5 Strategies to Lower Your Auto Insurance Premiums

Reducing your auto insurance premiums can greatly ease your financial burden. Here are the top strategies you can employ to achieve this:

- Shop Around for Quotes: Different insurance companies have varying rates, so it's essential to compare multiple quotes. Websites and tools that aggregate insurance quotes can save you time and help you find the best deal.

- Increase Your Deductible: A higher deductible means you'll pay more out of pocket in the event of a claim, but it can significantly lower your monthly premiums. Consider your financial situation and choose a deductible that works for you.

In addition to these initial strategies, make sure to take advantage of potential discounts. Here are three effective ways to save:

- Bundle Your Policies: Many insurers offer discounts if you buy multiple policies, such as combining auto and home insurance.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations can lead to lower rates. Insurance companies reward safe drivers with discounts.

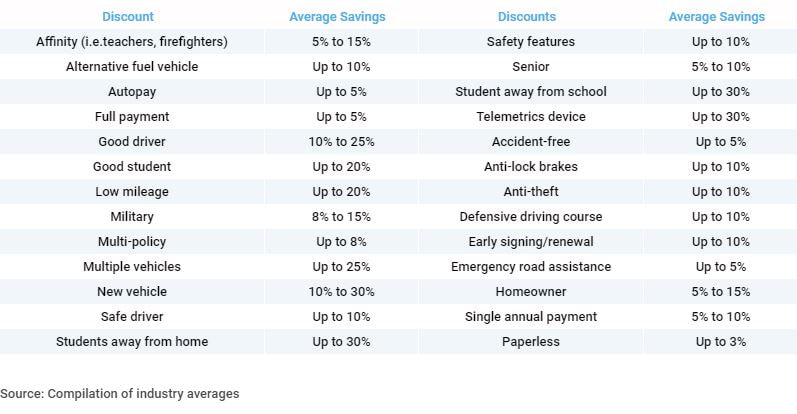

- Join a Student or Affiliation Program: If you're a student or a member of certain organizations, you may be eligible for additional discounts on your premiums.

How to Effectively Compare Auto Insurance Rates: A Step-by-Step Guide

Comparing auto insurance rates can seem daunting, but with a systematic approach, it becomes manageable. Start by gathering quotes from multiple insurance providers. You can do this through online comparison tools, or by directly contacting insurance companies. Make sure to have your vehicle information, driving history, and any discounts you're eligible for at hand. Once you have several quotes, create a table to organize the details, such as premiums, deductibles, and coverage limits, which will make it easier to identify the best options available.

After organizing your quotes, it's crucial to analyze what each policy offers beyond just the price. Look for coverage limits, deductibles, and essential features like roadside assistance and rental car reimbursement. Additionally, consider the reputation of the insurance providers by checking customer reviews and financial ratings. This step can save you from a low-cost policy that offers poor service or limited coverage. Finally, confirm any discounts you might qualify for, such as multi-policy discounts, which can further reduce your rates.

Are You Paying Too Much for Car Insurance? Common Mistakes to Avoid

Are you wondering if you might be paying too much for car insurance? Many drivers leave money on the table simply by overlooking essential details during the policy shopping process. One common mistake is failing to shop around and compare quotes from multiple insurance providers. Not all insurers offer the same rates, and a diligent comparison can often reveal significant savings. Additionally, some customers mistakenly stick with their current provider due to loyalty, unaware that they might be eligible for discounts with a different insurer.

Another prevalent error involves not regularly reviewing and updating your coverage. Life changes, such as moving to a different state or acquiring new vehicles, can impact your insurance needs. Car insurance premiums may be reduced by increasing your deductibles or taking advantage of bundling options with other types of insurance, such as home or renters insurance. To ensure you are not overpaying, it is crucial to re-evaluate your policy annually, scrutinizing coverage levels and discounts that may apply.