CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Forex Trading: The Unexpected Rollercoaster of Currency Chaos

Experience the wild ride of Forex trading! Discover unexpected twists and turns in the currency chaos that every trader faces.

Understanding Market Volatility: Why Currency Fluctuations Happen

Understanding market volatility is essential for anyone involved in trading or investing in currencies. Currency fluctuations occur due to a variety of factors, including economic indicators, interest rates, and geopolitical events. For instance, when a country experiences a change in its economic status, such as a significant increase in employment rates or GDP, its currency often strengthens against others. Conversely, political instability can lead to uncertainty, prompting investors to move their money out of a country, which can weaken its currency. These dynamics create a constantly changing landscape in the currency markets, making it crucial for traders to stay informed.

Another important aspect of market volatility is the impact of global events and central bank policies. Central banks play a pivotal role in managing currency values through monetary policy tools such as interest rate adjustments and quantitative easing. When a central bank raises interest rates, it typically strengthens the currency as it attracts foreign capital seeking higher returns. Additionally, unforeseen events, such as natural disasters or trade disputes, can lead to sudden market changes. Understanding these factors not only helps traders anticipate market movements but also enables them to make more informed decisions, ultimately leading to better risk management strategies.

Top Strategies to Navigate the Forex Market's Wild Swings

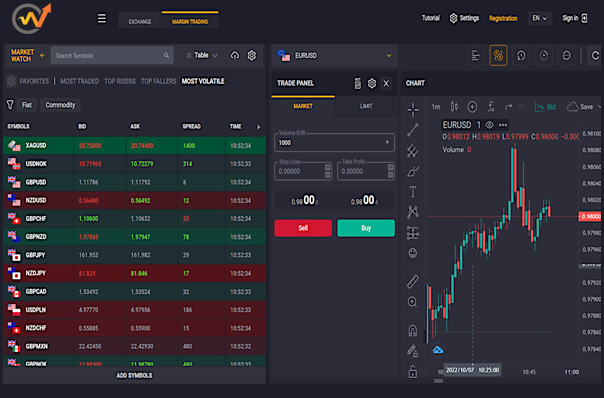

Navigating the Forex market's wild swings can be daunting, but with the right strategies, traders can position themselves for success. Risk management should always be a top priority. Setting stop-loss orders can protect your investments in the event of sudden market movements. Additionally, consider using position sizing techniques to ensure that no single trade can significantly impact your overall portfolio. Volatility analysis is another crucial aspect; by studying price fluctuations, traders can identify trends and potential entry and exit points. Utilizing tools like Bollinger Bands can help you gauge market volatility and make informed decisions.

In addition to technical analysis, staying updated on economic news is essential for navigating Forex's turbulence. Major economic indicators, such as interest rates and employment reports, can drastically influence currency values. To keep informed, subscribe to relevant financial news outlets and consider creating a trading calendar to track important events. Social trading platforms can also provide insights from experienced traders, helping you adjust your strategies accordingly. By combining technical analysis and economic awareness, you can better withstand the market's wild swings and enhance your trading effectiveness.

What Factors Drive Currency Prices? A Deep Dive into Forex Dynamics

The dynamics of currency prices in the foreign exchange (Forex) market are influenced by a multitude of factors, each playing a crucial role in determining the relative value of one currency against another. One of the primary drivers is interest rates, which are set by central banks and impact the attractiveness of a currency for investors. Higher interest rates offer better returns on investments denominated in that currency, leading to increased demand and, consequently, a rise in its value. Additionally, economic indicators, such as GDP growth, employment rates, and inflation, provide insights into a country's economic health, further affecting currency valuation.

Another significant factor is geopolitical stability. Countries experiencing political turmoil or uncertainty often see their currency devalue as investors seek safer havens. Market sentiment also plays a pivotal role; it reflects the general attitude of investors towards a particular currency based on news, reports, and speculation. Finally, international trade balances can influence currency prices as well. A country with a trade surplus typically sees an increase in demand for its currency, as trading partners need to buy that currency to pay for goods. Understanding these factors is essential for anyone looking to navigate the complexities of the Forex markets successfully.