CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance Battles: How to Choose Your Champion

Uncover the secrets to winning the insurance battle! Choose the right champion and protect what matters most. Dive in now!

Understanding Different Types of Insurance: Which One is Right for You?

Understanding the various types of insurance available is crucial for making informed decisions that can protect you and your assets. The main categories include health insurance, which covers medical expenses; auto insurance, essential for vehicle protection; homeowners insurance, safeguarding your property; and life insurance, ensuring financial security for your loved ones in the event of your passing. Each type serves a specific purpose and is tailored to different needs, making it vital to assess your personal situation before selecting a policy.

To determine which type of insurance is right for you, consider the following factors:

- Your Lifestyle: Evaluate your daily activities and the potential risks associated with them.

- Your Financial Situation: Analyze your current financial standing and how much you can afford to spend on premiums.

- Your Dependents: If you have family or others relying on you, life insurance may be a priority.

By carefully considering these aspects, you can select an insurance policy that meets your specific needs and provides peace of mind.

Top 5 Factors to Consider When Choosing an Insurance Provider

When it comes to selecting an insurance provider, there are five crucial factors that can significantly impact your decision. First and foremost, consider the provider's financial stability. A reputable insurance company should have a solid financial standing, ensuring they can meet claims obligations when needed. Check ratings from independent agencies to gauge their reliability. Additionally, examine their range of coverage options. Different providers offer varying policies, so it’s essential to find one that meets your specific needs—be it auto, home, health, or life insurance.

Customer service plays a pivotal role in your overall experience with an insurance provider. Look for companies with responsive support teams and strong customer reviews. A good insurance provider should make it easy for you to file claims and get assistance when needed. Lastly, consider the premium costs and any discounts offered. While the cheapest option might be tempting, ensure you're also getting value for your coverage. Balancing cost with quality service and coverage can lead you to the best choice for your insurance needs.

Insurance Showdown: How to Evaluate Your Options and Pick the Best Champion

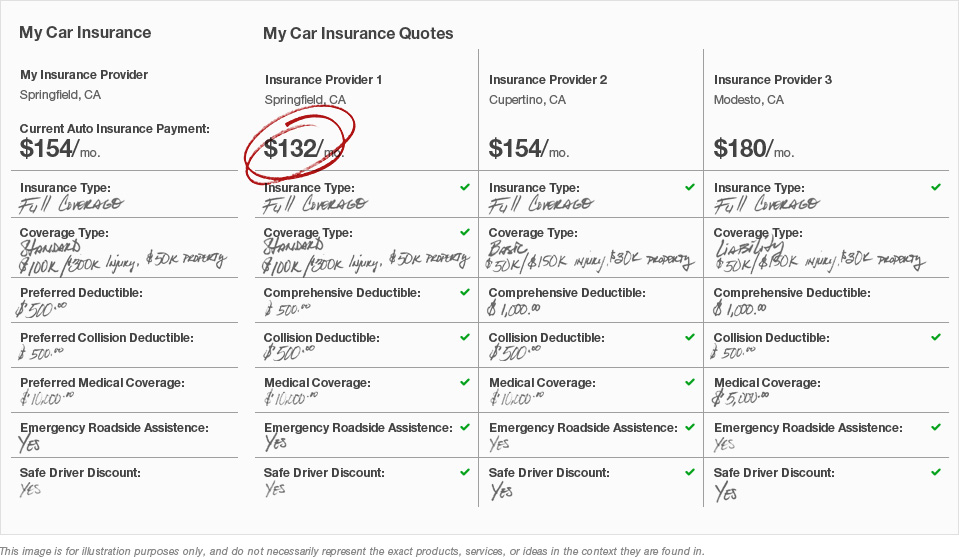

When it comes to insurance, evaluating your options is crucial for making the best choice for your needs. Start by identifying the types of coverage you require—whether it's health, auto, home, or life insurance. Once you have a clear idea of your requirements, create a comparison chart that outlines the policies offered by different insurers. This chart should include key factors such as premiums, deductibles, coverage limits, and customer service ratings. By analyzing these elements side by side, you can easily spot which providers offer the best value for your specific situation.

Next, consider gathering customer reviews and testimonials for each insurance company you are evaluating. Checking online forums, social media, and consumer advocacy websites can provide insights into the experiences of others with these companies. Additionally, don’t hesitate to reach out to friends or family for their recommendations. After gathering all pertinent information, weigh the pros and cons of each option and trust your instincts. Choosing the right insurance is not just about numbers; it's about finding a provider that feels like a champion for your needs and that you can rely on when it matters most.