CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance Coverage That Won't Leave You High and Dry

Discover insurance coverage that truly protects you. Don't get caught off guard—find the right plan today and stay secure!

Top 5 Insurance Coverage Options to Keep You Secure

When it comes to protecting your assets and ensuring peace of mind, understanding your insurance options is crucial. Here are the Top 5 Insurance Coverage Options to keep you secure:

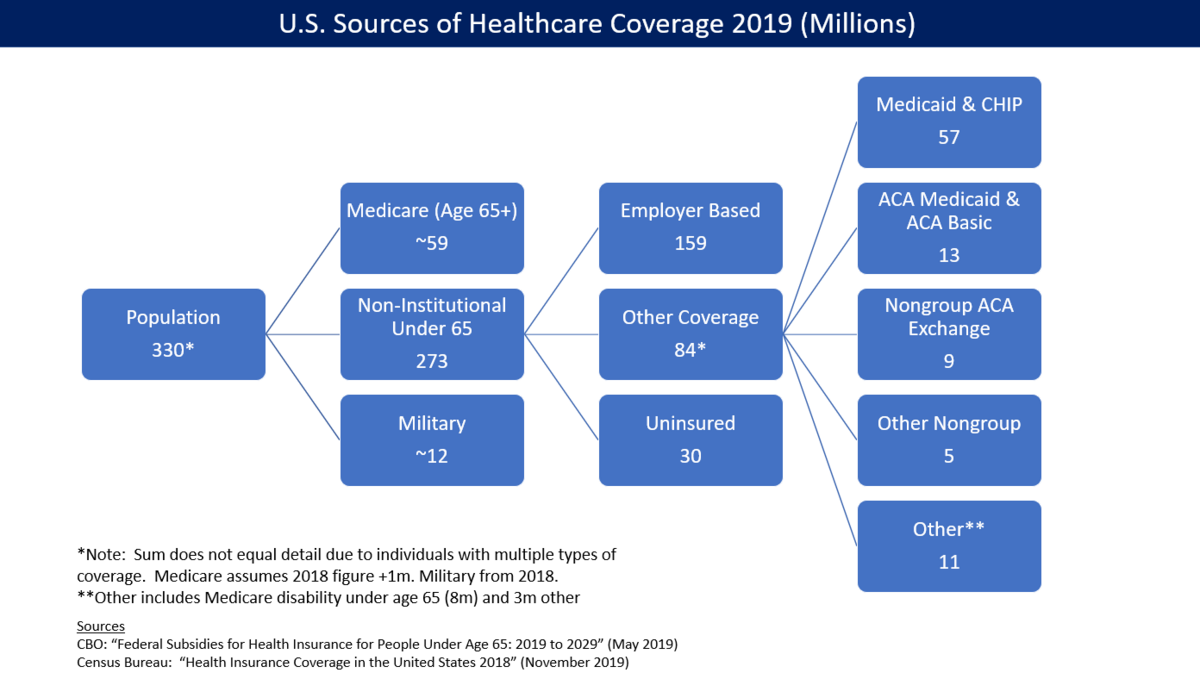

- Health Insurance: This type of coverage helps pay for medical expenses, ensuring that unexpected health issues won't break the bank.

- Auto Insurance: This is essential for anyone who drives, as it covers damages to your vehicle and liability in case of accidents.

- Homeowners Insurance: Protects your home and belongings against risks such as fire, theft, and natural disasters.

- Life Insurance: Provides financial support to your loved ones in the event of your untimely passing, securing their future.

- Disability Insurance: This coverage ensures that you receive income if you're unable to work due to a disability, offering you a financial safety net.

How to Choose Insurance Coverage That Fits Your Needs

When selecting insurance coverage, it's crucial to start by evaluating your personal needs and circumstances. Begin by making a list of the types of coverage you might require, which could include health, auto, home, or life insurance. Consider factors such as your age, health status, lifestyle, and financial situation. For instance, a young, healthy individual may prioritize health insurance differently than someone planning for retirement. Additionally, understanding how much coverage you need will help you avoid overpaying for unnecessary policies.

Next, compare different insurance policies to ensure that you are getting the best value for your specific requirements. Look for key factors such as premiums, deductibles, coverage limits, and exclusions. It’s also wise to seek quotes from multiple insurers to gauge which policies provide the most competitive rates for the coverage you need. Remember, the cheapest option isn't always the best; assess the policy details carefully to ensure you’re making a well-informed decision.

Is Your Insurance Coverage Enough? Common Misconceptions Explained

When evaluating your insurance coverage, it’s common to fall prey to several misconceptions that can leave you underinsured. One prevalent myth is that having any insurance policy means you are fully protected. In reality, many people mistakenly believe that their employer-sponsored health insurance or a basic renters insurance policy will cover all their needs. However, the limits of these policies can leave you exposed to significant financial risks. For instance, health insurance typically has deductibles and out-of-pocket maximums that can be quite high, potentially leading to unexpected costs during medical emergencies.

Another widespread misconception is that insurance coverage is a one-time decision rather than an ongoing assessment. Life changes such as marriage, home purchases, or having children can significantly impact your insurance needs. Consequently, many individuals neglect to update their policies, assuming that previous coverage will suffice. Regularly reviewing your insurance coverage ensures that you are adequately protected against unforeseen events. Always ask yourself, Is your insurance coverage enough to safeguard your assets and protect your family's future?