CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Insurance for the Unexpected: Why Renters Sleep Better

Discover why renters sleep soundly with insurance for the unexpected—protect your peace of mind and secure your future today!

Understanding Renters Insurance: What You Need to Know for Peace of Mind

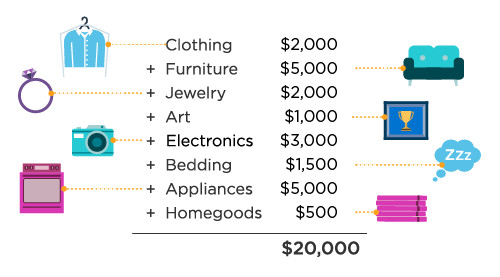

Understanding Renters Insurance is crucial for anyone living in a rented property. Unlike homeowners insurance, which covers the structure of the home itself, renters insurance provides coverage for your personal belongings within the rental unit. This means that if your items are stolen, damaged, or destroyed due to events such as fire or water damage, your renters insurance can help you replace them. It's essential to assess the total value of your possessions to ensure you choose a policy that meets your needs adequately.

Moreover, renters insurance often includes liability protection, which can cover legal costs if someone is injured while visiting your home. You may also want to consider additional factors like mandatory coverage for natural disasters or personal property limits. By understanding the intricacies of your policy, you can enjoy the peace of mind that comes with knowing you are financially protected. Don't leave your valuable possessions unprotected; investing in renters insurance is a smart choice for safeguarding your future.

Top 5 Reasons Renters Insurance Protects Against the Unexpected

Having renters insurance is essential for anyone who is renting a home or an apartment, as it provides crucial protection against unexpected events. Here are the top five reasons why renters insurance is a wise investment:

- Personal Property Protection: Renters insurance covers the loss or damage of your personal belongings due to theft, fire, or natural disasters.

- Liability Coverage: If someone is injured while visiting your rental property, renters insurance can help cover legal fees and medical expenses, protecting your financial well-being.

- Temporary Living Expenses: In the event that your home becomes uninhabitable due to a covered incident, renters insurance can help pay for temporary housing and living expenses.

- Peace of Mind: Knowing that you are protected against unforeseen events can provide immense peace of mind, allowing you to focus on enjoying your home.

- Affordability: Most renters insurance policies are affordable, often costing less than a dinner out, making it a cost-effective way to protect your assets.

In summary, renters insurance is more than just an additional expense; it is a crucial safeguard that protects against unexpected financial burdens. By investing in renters insurance, you are not only protecting your personal belongings and assets but also ensuring that you have a safety net in place should any unforeseen circumstances arise. Don't wait for the unexpected to happen—consider securing a renters insurance policy today!

Is Renters Insurance Worth It? Debunking Common Myths

Is renters insurance worth it? This question often surfaces among tenants who are skeptical about the necessity of insurance coverage for their personal belongings. Many people believe that they are covered under their landlord's insurance, but this is a common myth. Landlord policies typically only protect the building itself and do not extend to the personal property of renters. In fact, renters insurance offers a critical safety net by safeguarding your possessions against theft, fire, or water damage, ensuring that you won't face financial disaster in case of unforeseen events.

Another prevalent myth is the notion that renters insurance is too expensive. In reality, the cost of renters insurance is often quite affordable, with premiums averaging around $15 to $30 per month, depending on coverage limits and location. For many, this small monthly fee can offer immense peace of mind, covering not only personal property but also liability protection in case of accidents in your rental unit. Ultimately, weighing the potential losses against the affordable cost of insurance is crucial; you may find that not having a policy could be the riskier choice.