CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Paws and Policies: What You Didn't Know About Pet Insurance

Uncover the surprising truths about pet insurance! Discover secrets that every pet owner should know to protect their furry friends.

Understanding Pet Insurance: Essential Coverage You Need to Know

Pet insurance is a vital safety net for pet owners, providing coverage for unexpected medical expenses that can arise from accidents or illnesses. When choosing a policy, it’s essential to understand the various types of coverage available. Common options include accident only policies, which cover injuries resulting from accidents, and comprehensive plans, which encompass both accidents and illness. Some policies may also offer additional benefits such as routine care, dental coverage, and even behavioral therapy. Always evaluate your pet's specific needs and the potential risks to ensure you opt for the coverage that best suits your situation.

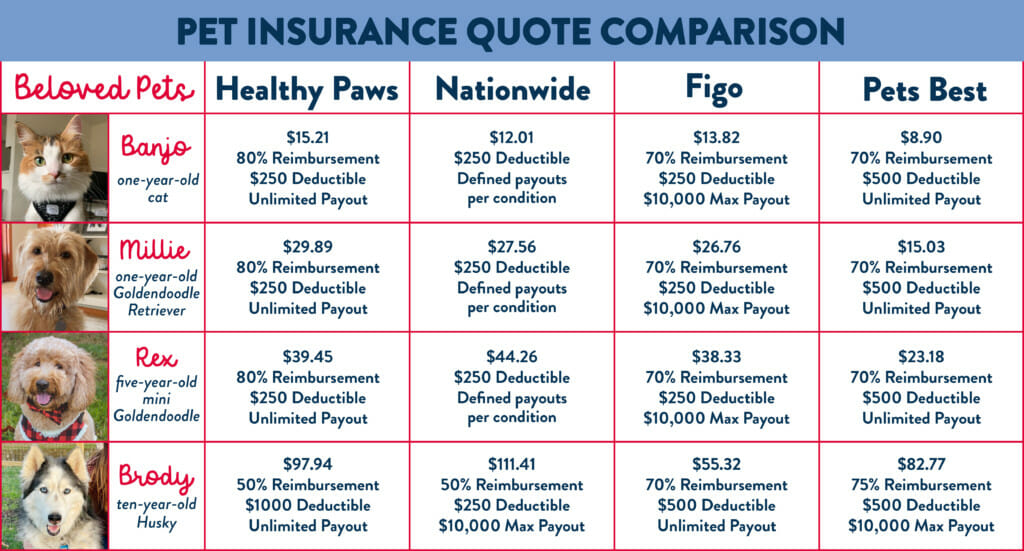

Another important aspect of pet insurance is the concept of reimbursement levels and deductibles. Most insurers allow pet owners to select a deductible, which is the amount you pay out of pocket before coverage kicks in. Additionally, policies may offer different reimbursement percentages, typically ranging from 70% to 90% after the deductible is met. It's crucial to read the fine print and understand any exclusions in the policy, such as pre-existing conditions, to avoid surprises when filing a claim. By familiarizing yourself with these components, you can make an informed decision and ensure your furry friend receives the care they need without financial strain.

Common Myths About Pet Insurance Debunked

When it comes to pet insurance, many pet owners are often swayed by common myths that can lead to confusion and misinformation. One of the most prevalent myths is that pet insurance is too expensive and not worth the cost. In reality, the average monthly premium is often less than the price of a fancy coffee, and the potential savings you can gain from unexpected veterinary bills can be significant. By investing in pet insurance, you're not just buying a policy; you're ensuring peace of mind for both you and your furry friend.

Another widespread myth is that pet insurance is only necessary for older or sick pets. This is far from the truth! Accidents and illnesses can strike pets of any age, and having a policy in place can provide crucial financial support when it's needed most. A healthy pet without insurance might face overwhelming bills in case of sudden injuries or illnesses, ultimately leading to tough choices for their owners. Ultimately, investing in pet insurance early on pays off by covering routine care as well as unexpected emergencies, ensuring a healthier future for your beloved companion.

What to Look for When Choosing a Pet Insurance Plan

Choosing the right pet insurance plan is crucial for ensuring your furry friend's health and well-being. When evaluating different options, it's essential to consider factors like coverage limits, deductibles, and premium costs. Start by assessing what is included in the policy, such as accidents, illnesses, and routine care. Additionally, look for any exclusions that may leave you vulnerable. A comprehensive plan should offer a balance between affordability and extensive coverage to best suit your pet's needs.

Another significant aspect to explore is the network of vets available under the insurance plan. Some insurers may require you to visit specific clinics or have a limited selection of veterinarians. Reading customer reviews can provide insight into the company’s reliability and the efficiency of their claims process. Moreover, don’t forget to check if they offer wellness packages that cover preventive care, as this can be beneficial in the long run. Ultimately, thorough research will empower you to make an informed decision for your beloved pet.