CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Quote Me Maybe: The Surprising Secrets Behind Insurance Pricing

Uncover the hidden truths of insurance pricing that could save you money! Discover the secrets in Quote Me Maybe—your wallet will thank you!

Understanding the Factors That Influence Your Insurance Premiums

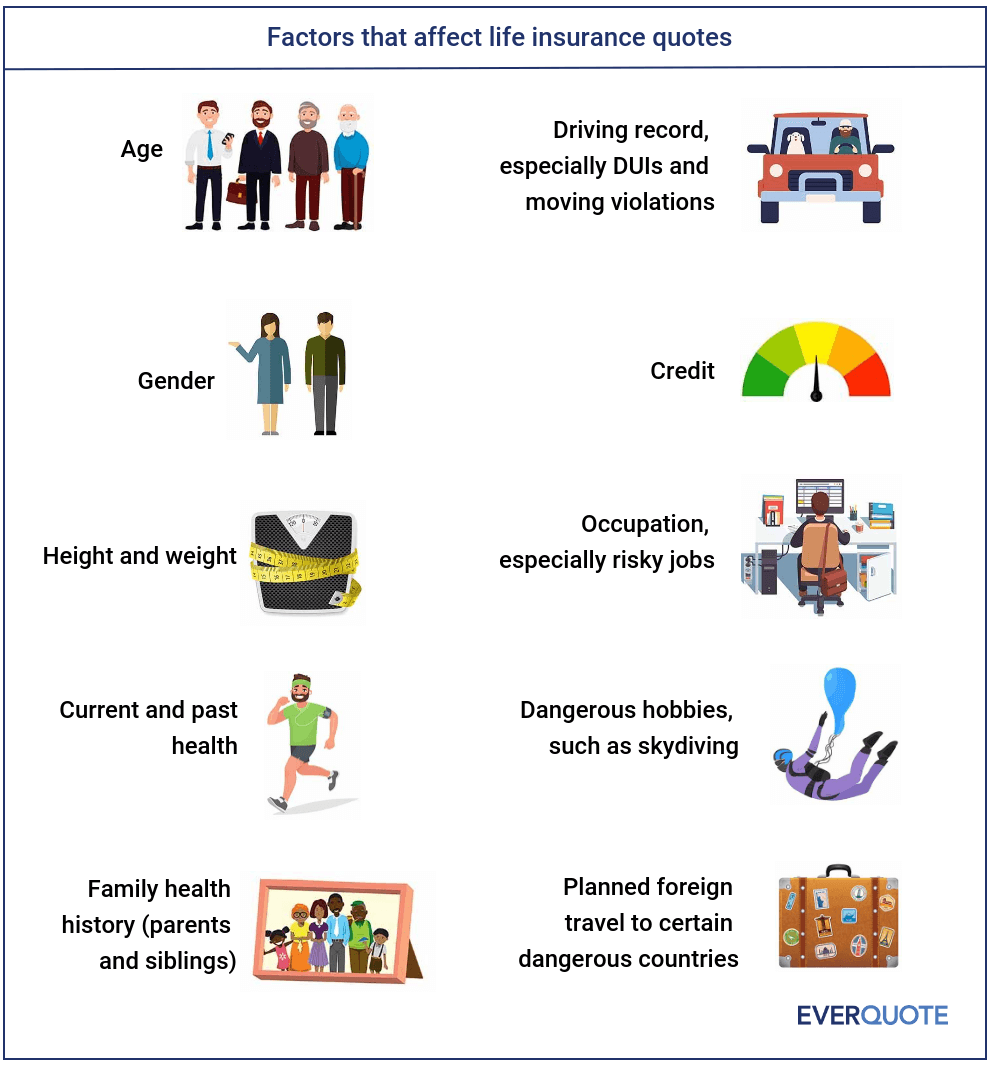

Understanding the factors that influence your insurance premiums is crucial for anyone looking to manage their financial health. Several key elements come into play when determining the amount you pay for coverage. These include personal factors such as age, gender, and credit score, as well as external factors like location and the type of coverage you choose. For instance, younger individuals might face higher rates due to a lack of driving experience, while someone in a high-crime area might see their premiums rise to account for increased risk.

Additionally, the insurance company itself plays a significant role in determining your premiums. Each provider has its own underwriting criteria, which can lead to differences in pricing for the same coverage. Claims history, whether your own or of similar individuals, also significantly impacts your rates. It's advisable to shop around and compare quotes from different insurers, as even slight changes in their risk assessment could save you money. Understanding these nuances can empower you to make informed decisions and potentially lower your insurance costs.

Are You Paying Too Much? Unveiling the Secrets of Insurance Pricing

Are you paying too much for your insurance? It’s a critical question that many consumers overlook as they renew their policies year after year. Understanding the factors that influence insurance pricing can empower you to make informed decisions and potentially save a significant amount of money. Insurance companies often use complex algorithms and personal data to determine your premiums, including your age, location, claims history, and even your credit score. By becoming familiar with these underlying elements, you can strategically navigate the insurance landscape and identify areas where you might be overpaying.

One of the secrets of insurance pricing lies in the discounts and bundling options that are frequently available but not widely advertised. Many insurance providers offer discounts for safe driving, multiple policies, or even membership in specific organizations. Additionally, bundling your home and auto insurance can result in significant savings. Therefore, it's essential to regularly review your policies and assess whether you qualify for any applicable discounts. Taking the time to compare quotes from various insurers can also reveal disparities in pricing, enabling you to secure the best deal possible and ensuring you’re not paying too much for your coverage.

The Myth of the One-Size-Fits-All Policy: How Insurers Calculate Your Rates

The concept of a one-size-fits-all policy in insurance is a pervasive myth that can lead to misunderstandings about how rates are determined. Each individual's circumstances—ranging from age and driving history to location and type of coverage—contribute to a personalized risk assessment that insurers use to calculate premiums. Insurers utilize complex algorithms and statistical models to analyze data and predict potential claims, ensuring that the rates reflect the unique risk profile of each policyholder rather than applying a generic, uniform rate across the board.

Moreover, the factors influencing your premium are not merely about your personal profile. Insurers also consider market trends, regional statistics, and even legislative changes when developing their pricing models. For example, if a particular area experiences a rise in accidents or natural disasters, the rates for residents in that region may disproportionately increase. Understanding this multifaceted approach highlights why it's crucial to avoid the assumption that a standard policy will adequately cover your specific needs. Instead, evaluating your individual risk factors can help you find a more tailored insurance solution.