CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Save Big on Auto Insurance: It's Easier Than You Think!

Unlock massive savings on auto insurance today! Discover simple tips and tricks to lower your premiums effortlessly.

5 Simple Steps to Lower Your Auto Insurance Premiums

Lowering your auto insurance premiums doesn't have to be a daunting task. By following 5 simple steps, you can significantly reduce your monthly expenses. The first step is to shop around for the best rates. Compare quotes from multiple insurance providers to find the one that meets your needs and budget. Secondly, consider increasing your deductibles. A higher deductible can lead to lower premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

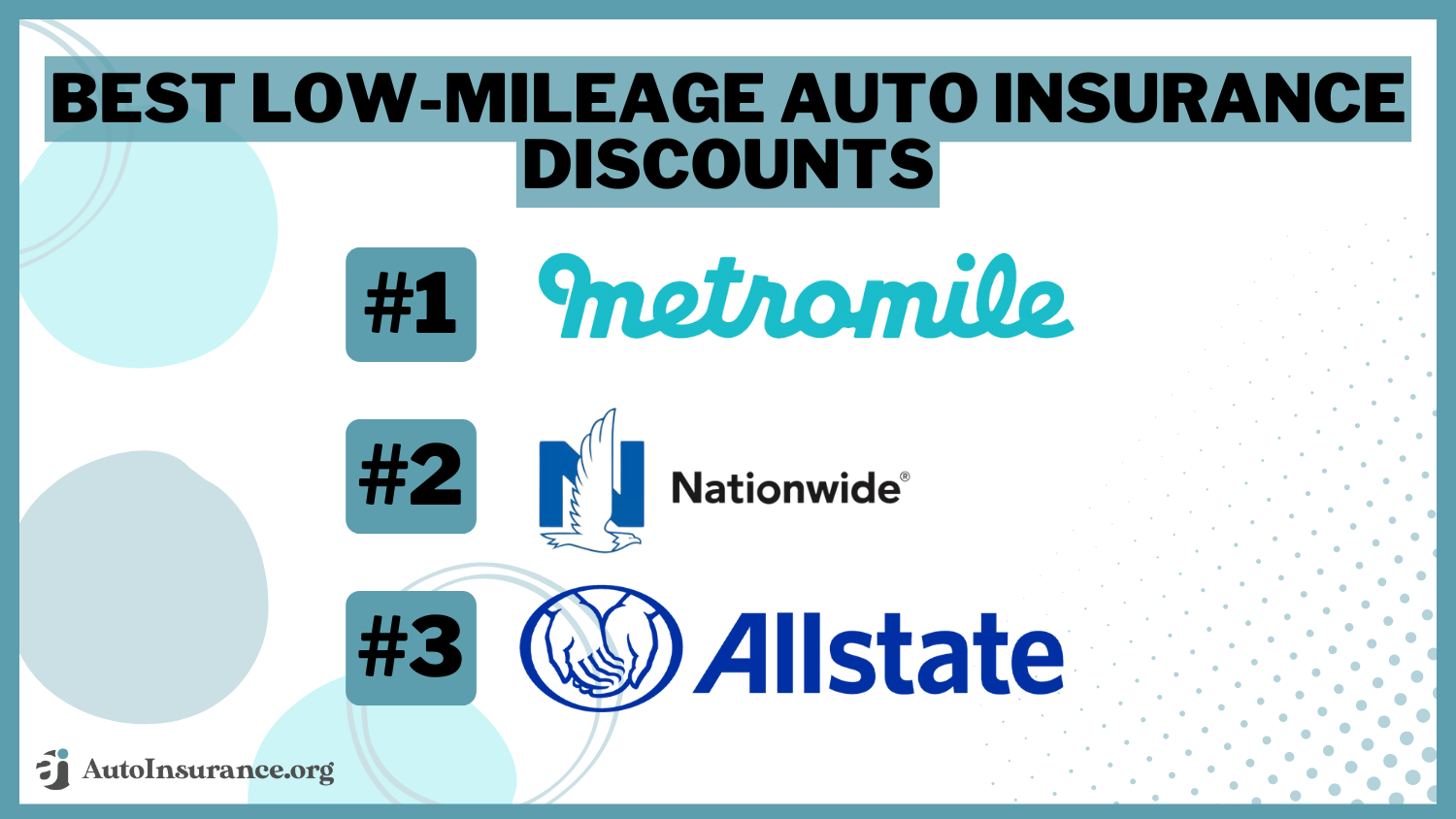

Next, take advantage of discounts that many auto insurance companies offer. These can include safe driver discounts, multi-policy discounts, and even discounts for taking defensive driving courses. The fourth step is to review your coverage regularly. As your circumstances change, such as your car's value or your driving habits, you may find that you can eliminate unnecessary coverage or adjust your limits. Finally, maintain a good credit score, as many insurers use credit information to determine premiums. Implementing these strategies can help you save money on your auto insurance without sacrificing coverage.

Common Misconceptions About Auto Insurance Savings

Many drivers believe that the best way to save on auto insurance is by simply shopping for the lowest premium. While it's true that comparing rates can help you find a better deal, it's a misconception that a cheap policy is always the best choice. In reality, auto insurance savings are often more about the coverage and deductibles you choose. A lower premium may mean higher out-of-pocket costs in the event of a claim, which can ultimately lead to more expenses over time.

Another common myth is that all auto insurance providers offer the same discounts. In fact, discounts can vary significantly between different insurers. For instance, some companies may provide reductions for safe driving records, while others may offer savings for bundled policies or certain safety features in your vehicle. To truly maximize your auto insurance savings, it’s essential to inquire about all potential discounts and tailor your coverage to best fit your needs.

How to Compare Auto Insurance Quotes Effectively

Comparing auto insurance quotes effectively requires a systematic approach that helps you understand the true cost of coverage. Start by gathering quotes from multiple insurance providers, as this will allow you to see a range of options. Be sure to provide the same information to each insurer to ensure an accurate comparison. Create a comparison chart that includes key details such as the premium amount, deductibles, coverage limits, and any discounts available. This visual aid will help you evaluate which policies provide the best value for your needs.

Next, consider not just the price, but also the quality of coverage. Look for crucial factors like customer service ratings, policy exclusions, and the claim process. Websites that aggregate customer reviews can be helpful here. Additionally, make sure to understand the coverage types included in each quote, such as liability, collision, and comprehensive coverage. A lower premium might not always translate to the best protection, so take your time to analyze these elements thoroughly before making your decision.