CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Term Life Insurance: Because Life is Too Short for Bad Choices

Secure your family's future with smart choices in term life insurance. Discover how to protect what matters most before it's too late!

Understanding Term Life Insurance: Key Benefits for Your Family

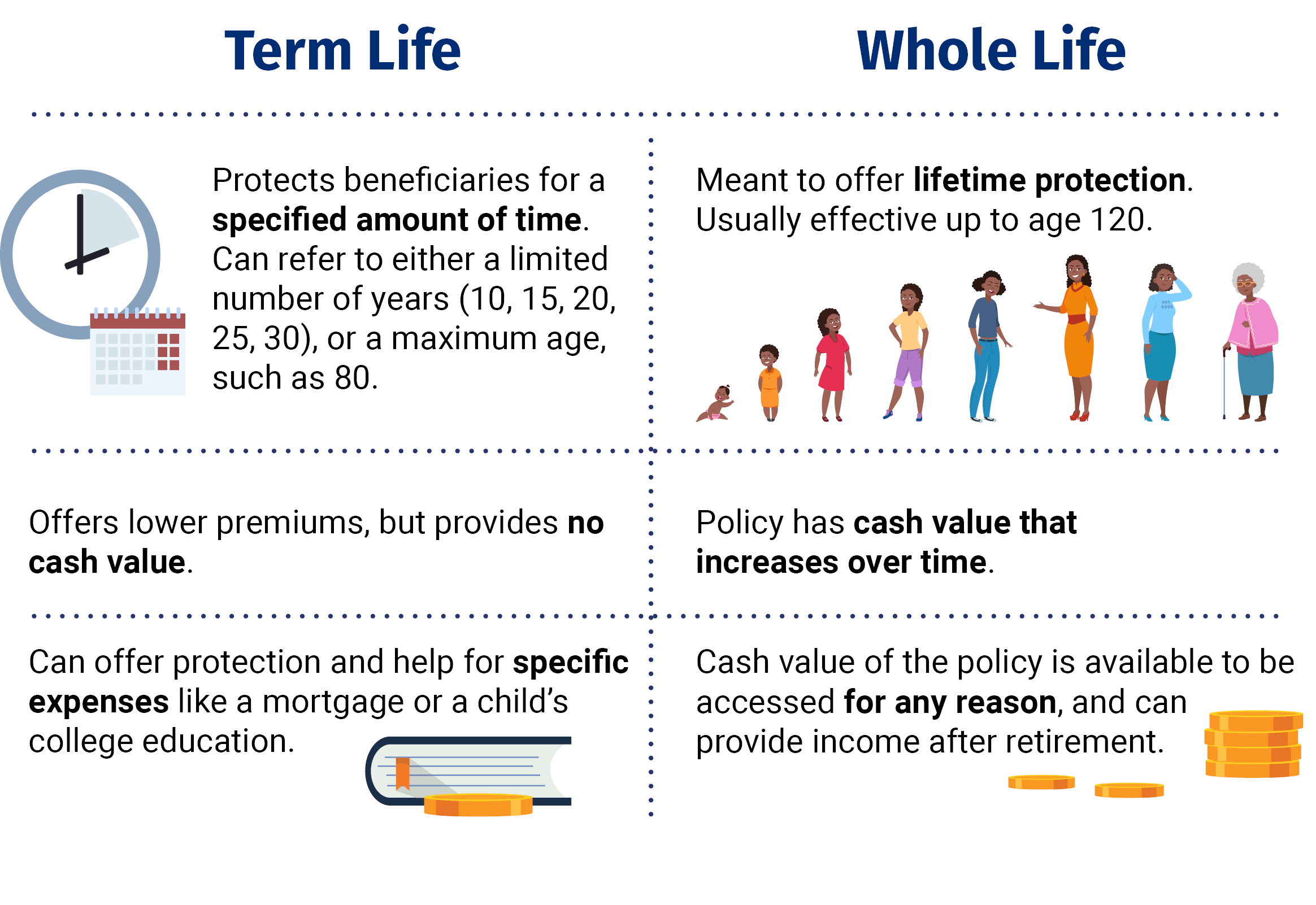

Term life insurance is a flexible and affordable option for families looking to secure their financial future in case of an unexpected loss. With a predetermined coverage period, usually ranging from 10 to 30 years, it allows policyholders to provide crucial financial support to their loved ones during these critical years. Some key benefits of term life insurance include its lower premiums compared to whole life insurance, the ability to choose a coverage amount that aligns with your family's needs, and the option to convert to a permanent policy later on if desired.

One of the most significant advantages of term life insurance is its straightforward structure, making it easy for families to understand. It is designed to provide financial security by paying a death benefit that can help cover living expenses, debts, and even children's education costs. In essence, this insurance ensures that your family is not left in a precarious financial situation while navigating the emotional aftermath of a loss. By choosing term life insurance, you invest in peace of mind for yourself and financial protection for your family.

Top 5 Common Myths About Term Life Insurance Debunked

Term life insurance is often surrounded by misconceptions that can lead to confusion and misplaced fears. One of the most prevalent myths is that term life insurance is only beneficial for young families. This is not true; while it may be especially useful for covering young families with dependents, individuals at any life stage can benefit from a term policy. Coverage can be crucial for anyone looking to secure their financial future, regardless of age, especially if there are financial obligations or debts that would need to be addressed after one’s passing.

Another common myth is that term life insurance doesn’t carry any value and simply expires once the term ends. In reality, term life insurance provides financial protection during a specified period, and many policies allow for renewal or conversion to permanent insurance, which can be a valuable option for policyholders as they age. Additionally, the affordability of term policies makes them an excellent choice for those looking to balance coverage with budget, debunking the myth that all life insurance is prohibitively expensive.

Is Term Life Insurance Right for You? Questions to Consider

Deciding whether term life insurance is right for you involves careful consideration of your financial situation and future needs. Start by evaluating your current and projected expenses, including debts, mortgage payments, and children's education costs. Ask yourself: How much coverage do I need to ensure my loved ones are financially secure? Also, think about the length of coverage you require; term life insurance typically provides protection for a specific period, such as 10, 20, or 30 years, which aligns with your financial obligations.

In addition to assessing your coverage needs, consider your health and lifestyle. For instance, patients with pre-existing health conditions may find term life insurance to be a more accessible and affordable option compared to permanent life insurance. Furthermore, think about your family situation: Are you a parent with dependents who rely on your income? If so, term life insurance can be a practical choice to safeguard their financial future during critical years. To summarize, ask yourself the following questions:

- What debts do I have that need to be covered?

- How long do I want my beneficiaries to be protected?

- What is my current and projected financial situation?

- Do I have any health issues that could affect my coverage options?