CS:GO Skins Hub

Explore the latest trends and tips on CS:GO skins.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover how term life insurance can be your lifesaver! Uncover the protection you didn't know you needed for peace of mind today.

Understanding Term Life Insurance: Key Benefits Explained

Term life insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. It is designed to protect your loved ones financially in the event of your untimely death during the term of the policy. One of the key benefits of term life insurance is its affordability. Since it offers pure insurance without any investment component, premiums are generally lower than those of permanent life insurance policies. This allows individuals and families to secure substantial coverage at a relatively low cost, making it an attractive option for young families or those on a budget.

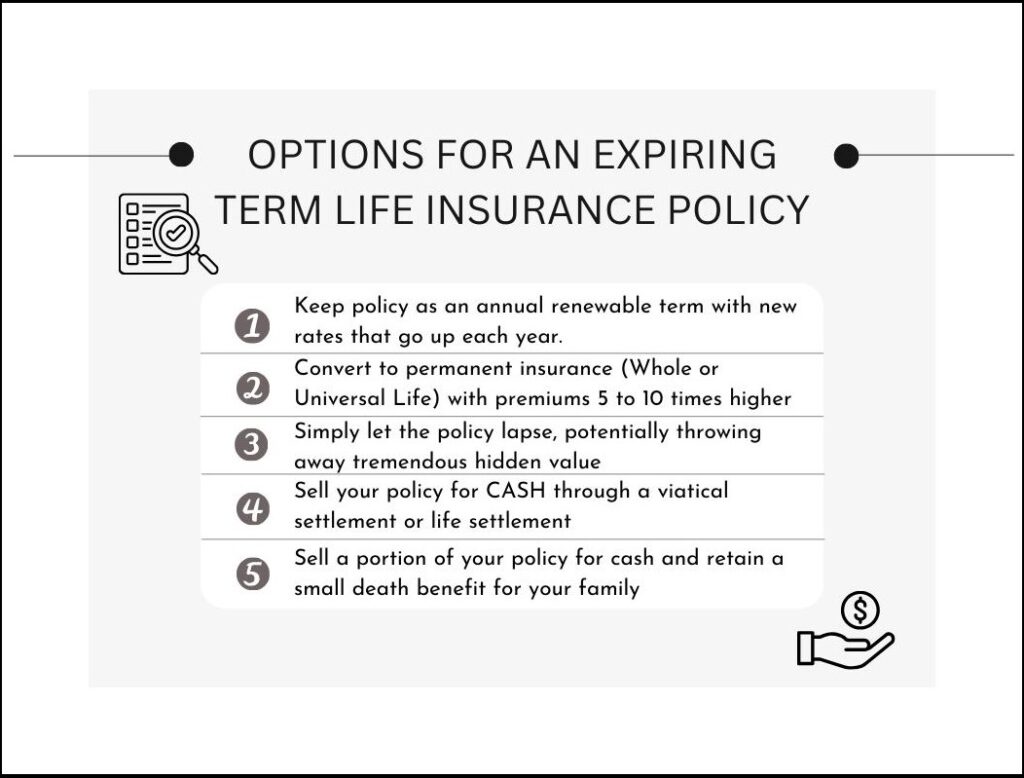

Another significant advantage of term life insurance is its simplicity. Unlike permanent life insurance, which can have complicated features and varying cash value elements, term policies are straightforward. You select the term, agree to the premium, and in exchange, your beneficiaries receive the death benefit if you pass away during the term. Furthermore, many policies offer options to renew or convert to permanent coverage at the end of the term, providing flexibility as your financial situation changes over time. This makes term life insurance a practical choice for short-term needs and those seeking peace of mind without the complexities of more comprehensive products.

Is Term Life Insurance Right for You? Important Questions to Consider

Choosing whether term life insurance is right for you involves evaluating your financial needs and personal circumstances. Start by asking yourself how much coverage you require. Consider any debts, such as a mortgage or student loans, and think about your family's future expenses, like education costs for children. It's also essential to reflect on your current income and how long you want your beneficiaries to be financially protected. A common recommendation is to have coverage that is 10 to 15 times your annual salary, ensuring your family is supported in the event of your passing.

Another crucial aspect to consider is the duration of coverage you need. Term life insurance typically offers coverage for a specific period, ranging from 10 to 30 years. Ask yourself if you primarily need protection during crucial periods, such as while raising children or paying off a mortgage. Furthermore, evaluate your health and age, as these factors can significantly impact your premiums. In conclusion, carefully weighing these considerations will help you determine if term life insurance is the right choice for you and your family's financial security.

How Term Life Insurance Provides Financial Security for Your Loved Ones

Term life insurance is a crucial financial product that offers a safety net for your loved ones in the event of your untimely passing. This type of policy provides a death benefit to your beneficiaries, which can be used to cover essential expenses such as mortgage payments, educational costs, and daily living expenses. By securing a term life insurance policy, you ensure that your family maintains their standard of living and is financially secure even when you are no longer there to support them.

When considering term life insurance, it is important to assess your family's financial needs and the duration for which coverage is necessary. Most policies offer flexible terms ranging from 10 to 30 years, allowing you to tailor coverage based on your unique situation. Moreover, since term life insurance typically comes at a lower premium compared to whole life insurance, it offers an affordable way to provide peace of mind knowing that your loved ones will have financial support during a difficult time.